Processing thousands of loan applications in a few minutes or detecting fraud before it happens; are just a few possibilities for RPA in banking.

With growing financial complexities, banks are turning to automation to streamline their operations and enhance customer experiences.

The banking sector is working hard to address the ever-increasing workload and keep up with the growing digitization and financial needs. This is where RPA in banking comes into play. Robotic process automation makes it easier to process huge volumes of transactions, give better services to their customers, and maintain regulatory compliance.

Moreover, automating business processes helps banks to streamline workflows, reduce errors, and enhance customer experiences. In this blog, we will explore how automation technology is changing the banking industry by helping them keep up with the increased demands.

.

Do you know?

Finance RPA (robotic process automation) is the only process automation technology in Gartner’s top 10 most valuable technologies for finance leaders in 2024..

What is RPA?

RPA refers to software technology that enables the automation of repetitive, rule-based tasks across various business processes.

Robotic process automation is helping financial institutions like banks meet their business needs. It resembles human behavior and is used for operations like data entry, transaction processing, and report generation.

The use of smart bots reduces manual efforts, cuts down on errors, and helps in the management of workflow. Therefore, they have become a perfect fit for banking, where accuracy and efficiency are in high demand.

Now, let’s discuss some of the most prominent use cases of RPA in the banking industry, contributing to their process improvement.

10 Use Cases of RPA in Banking – Why Do Banks Need RPA?

RPA is becoming a must as digital businesses grow. The volume of transactions has increased and customer expectations have gone even higher. So, the banks are looking for solutions to simplify workflow management without increasing costs.

Using RPA in banking is an efficient way of handling repetitive tasks. It allows humans to focus more on value-added activities. Workflow automation with robotics can also reduce error levels, optimize compliance processes, and enhance customer satisfaction.

Customer Onboarding

This is a tedious process where documents are verified, background checks are carried out, and customer records are updated in multiple systems. Automation technology makes the process simple by scanning to extract information from documents, identity verification, and real-time updating databases.

RPA in banking saves a lot of time while also cutting down on disruptive errors. Customers can be onboarded in minutes instead of days, which results in better customer experience and easier activation of accounts.

Loan Processing

The processing of loans includes checking credit scores and eligibility judgments. This process is time-consuming. However, business process automation saves time by automatically extracting data from various applications or systems.

Through this, banks can process loan applications faster and with fewer errors. These businesses comply better with regulatory requirements and deliver a better customer experience.

Anti-Money Laundering (AML) Compliance

AML requirements imposed on banks include monitoring customer transactions for suspicious activities. However, this involves data sifting through big blocks of data.

RPA can complement AML by automating data gathering and detection of patterns. This makes it easier to notice and flag suspicious transactions. The bots can look at transaction history and flag unusual ones for further investigation.

This makes fraud detection easier while ensuring banks maintain compliance without following through manually.

KYC (Know Your Customer) Process

KYC is an abbreviation of Know Your Customer. This is the process of a bank verifying the identification of the customers to stop fraud and money laundering.

Although necessary for regulatory reasons, this process is time-consuming. Here, the process automation solution works by pulling out the relevant. Then it performs real-time identity checks and data comparisons with existing records.

Bots can complete this repetitive data entry work after you deploy them. This reduces the overall cost of KYC processes for banks and helps them deliver better financial services.

Credit Card Processing

The credit card application processing involves verifying applicant information, assessment of credit history, and eligibility.

The whole workflow can be automated with RPA. Bots cross-check the applicant information with the existing database and verify the credit scores for eligibility. This not only increases the speed of approvals but also reduces the risk of errors. This business process automation would also minimize the risk of a data breach and identity theft.

Fraud Detection and Prevention

Fraud detection is monitoring the transactions and the pattern of customers to detect fraud activities.

RPA in banking can be used for data analysis in real time to highlight patterns that indicate fraudulent transactions. Bots can identify questionable activities, like sudden high spending or large transactions, and make the same available immediately for review by humans.

This helps in the prevention of fraud by the bank while adding more agility to the process.

Mortgage Processing

Mortgage processing refers to procedures like income verification and credit checks, among others. Automating processes with robotics helps in process management.

This reduces the time it would take to approve a mortgage. The bots seamlessly pull your customer data from several places and verify income statements for credit checks. This speeds up mortgage approvals and boosts customer satisfaction

It also frees up employees to do more work on intellectual tasks requiring human judgment, contributing to process improvement.

Account Closure

If a customer confirms the closing of an account, banks must follow a sequential process without breaching the norms. With RPA, the account closure process can be automated.

It will perform all required verifications, update the records, and notify the concerned departments. This would ensure the time taken to close the account is reduced and there is no human error. Banks can also get relevant customer opinions regarding the closing of accounts.

Customer Service

Customer service groups in banks receive too many queries about account balances, transactions, and products.

RPA in banking can take over routine queries by integrating with chatbots or other AI-driven tools. They can use automation to answer every query while the human agent addresses only the complicated ones. This not only enhances the speed of response but also customer satisfaction and positively affects your ROI.

Account Reconciliation

Reconciling accounts is a very time-consuming process. It includes matching transactions between internal systems and external records to determine discrepancies.

An RPA bot can automate this process by cross-checking the data in different sources, identifying mismatches, and flagging them for human review. It decreases the time utilized for reconciliation, reduces disruptive errors, and ensures accurate financial records.

Moreover, automating these workflows in banking encourages compliance and stronger audit readiness, making it an end-to-end solution for businesses.

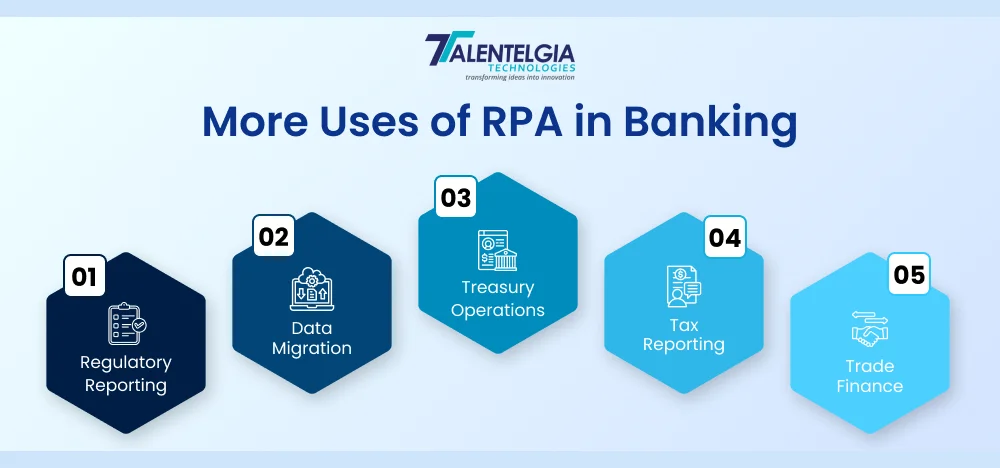

More Uses of RPA in Banking

RPA is already transforming financial institutions by adding more efficiency to their work process. However, the use cases of RPA in banking are not limited to the ones above.

According to Deloitte, RPA continues to meet and exceed expectations across multiple dimensions including improved compliance (92%), improved quality/accuracy (90%), improved productivity (86%), and cost reduction (59%).

So, continue reading below to find out how it is transforming their business process management (bpm) and helping them provide better financial services.

Regulatory Reporting

Banks deal with several reports that they submit to the regulators. Moreover, they need to accumulate and validate information from several systems. So, RPA can be used to automate operations like the collection and submission of reports to ensure their timely delivery and accuracy.

Data Migration

Regular updates of a bank system need data migration. The use of RPA in banking can automatically extract, transform, and load data between old systems and new systems. This helps in avoiding manual errors while hastening the process and adds scalability to the process.

Treasury Operations

Treasury operations management involves liquidity and fund transfer. Critical financial decisions can be taken quickly and more efficiently. With RPA, you can automate operations, save costs, and help the end users.

Tax Reporting

RPA can help prepare tax reports, and ensure that all data is up to date. So, there is minimal risk of errors and compliance regarding taxes. It works by eliminating the bottlenecks.

Trade Finance

The process of managing trade finance is a mundane task requiring a lot of paperwork. It includes invoices and shipping documents. RPA automates the verification of documents. This reduces time in transaction processing and makes your work model more agile.

Benefits of RPA to the Banks

RPA deployment has brought a lot of benefits for banks. Some of its advantages that help businesses overcome the increasingly competitive market scenario are reduced costs, better customer experience, and accuracy in business processes. Read below to find out more of these

Reduced Operational Costs

RPA saves the need for manual labor as it automates repetitive tasks. This saves on extensive wages as less manpower is needed for work such as data entry and processing. Moreover, there is a reduced risk of errors. These provide a one-time scalable solution that is capable of keeping up with your future needs.

Also Read: Robotic Process Automation Cost

Improved Customer Experience

RPA also increases the speed at which most processes are handled. For instance, customer onboarding, loan processing, and credit card applications are accelerated. Better processing means that customers benefit from receiving quicker services and answers to their questions.

Improved Accuracy

Manual processes sometimes involve human errors. Such errors can be costly, especially in financial environments. When you leverage RPA in banking, these errors do not occur as the software conducts work precisely, hence improving the accuracy of data and overall dependability.

Compliance and Risk Management

RPA in banking ensures that tasks are conducted by regulatory compliance, thus causing less risk of non-compliance by the respective banks. In addition, bots can always be programmed to maintain all the required detailed audit trails so that banks easily conform to regulatory standards.

Increased Productivity

With RPA taking over the repetitive tasks, employees will be free to focus on strategic work. This ultimately translates into increasing overall productivity and freeing banks from mundane issues, helping them improve business and deliver better financial services.

Future of RPA in Banking

The future looks promising for RPA in the banking sector. As AI development services and machine learning advances, RPA will evolve into more intelligent automation software. It will automate even more complex tasks, including predictive analytics for customer behavior and sophisticated fraud detection mechanisms.

So it is right to say that RPA is increasing and driving innovation in banking services. It adds more scalability with automated business processes.

How to Implement RPA in Banking: Step-by-Step Guide

However, implementing RPA in banking requires good planning and execution. It’s not only about the deployment bots but these must be integrated into the overall operational strategy of the bank. Follow the below steps when you deploy the chatbot for a seamless experience

Step 1: Identify Processes for Automation

First, identify processes for automation. These should be repetitive, rule-based tasks that consume a lot of time and resources.

Step 2. Select the Right RPA Tool

Select an RPA tool that is appropriate to the requirements of the bank. Choose the one that is scalable and integration-friendly with all the existing systems.

Step 3. Develop a Pilot Program

Execute RPA in a small area as a pilot project. Potential problems would come up, and necessary adjustments can be made before scaling up.

Step 4. Train employees

Train employees to collaborate with RPA bots, focusing on exception management and overseeing the automation process.

Step 5: Monitor and Scale

Monitor and scale up the RPA in banking by following the success of the pilot program. You will scale across departments and processes using the findings from the report.

Conclusion

By automating tasks RPA in banking is transforming the finance industry. It enhances accuracy and improves customer experience. Moreover, RPA in banking also can keep up with the fast pace of the digital world and guarantee efficient, compliant, and customer-friendly services. The adoption of RPA software is not just about the digital transformation of financial institutions but also about the agility of these institutions. The more artificial intelligence and machine learning advances, the more RPA will have to give the banking world.

Healthcare App Development Services

Healthcare App Development Services

Real Estate Web Development Services

Real Estate Web Development Services

E-Commerce App Development Services

E-Commerce App Development Services E-Commerce Web Development Services

E-Commerce Web Development Services Blockchain E-commerce Development Company

Blockchain E-commerce Development Company

Fintech App Development Services

Fintech App Development Services Fintech Web Development

Fintech Web Development Blockchain Fintech Development Company

Blockchain Fintech Development Company

E-Learning App Development Services

E-Learning App Development Services

Restaurant App Development Company

Restaurant App Development Company

Mobile Game Development Company

Mobile Game Development Company

Travel App Development Company

Travel App Development Company

Automotive Web Design

Automotive Web Design

AI Traffic Management System

AI Traffic Management System

AI Inventory Management Software

AI Inventory Management Software

AI Software Development

AI Software Development  AI Development Company

AI Development Company  AI App Development Services

AI App Development Services  ChatGPT integration services

ChatGPT integration services  AI Integration Services

AI Integration Services  Generative AI Development Services

Generative AI Development Services  Natural Language Processing Company

Natural Language Processing Company Machine Learning Development

Machine Learning Development  Machine learning consulting services

Machine learning consulting services  Blockchain Development

Blockchain Development  Blockchain Software Development

Blockchain Software Development  Smart Contract Development Company

Smart Contract Development Company  NFT Marketplace Development Services

NFT Marketplace Development Services  Asset Tokenization Company

Asset Tokenization Company DeFi Wallet Development Company

DeFi Wallet Development Company Mobile App Development

Mobile App Development  IOS App Development

IOS App Development  Android App Development

Android App Development  Cross-Platform App Development

Cross-Platform App Development  Augmented Reality (AR) App Development

Augmented Reality (AR) App Development  Virtual Reality (VR) App Development

Virtual Reality (VR) App Development  Web App Development

Web App Development  SaaS App Development

SaaS App Development Flutter

Flutter  React Native

React Native  Swift (IOS)

Swift (IOS)  Kotlin (Android)

Kotlin (Android)  Mean Stack Development

Mean Stack Development  AngularJS Development

AngularJS Development  MongoDB Development

MongoDB Development  Nodejs Development

Nodejs Development  Database Development

Database Development Ruby on Rails Development

Ruby on Rails Development Expressjs Development

Expressjs Development  Full Stack Development

Full Stack Development  Web Development Services

Web Development Services  Laravel Development

Laravel Development  LAMP Development

LAMP Development  Custom PHP Development

Custom PHP Development  .Net Development

.Net Development  User Experience Design Services

User Experience Design Services  User Interface Design Services

User Interface Design Services  Automated Testing

Automated Testing  Manual Testing

Manual Testing  Digital Marketing Services

Digital Marketing Services

Ride-Sharing And Taxi Services

Ride-Sharing And Taxi Services Food Delivery Services

Food Delivery Services Grocery Delivery Services

Grocery Delivery Services Transportation And Logistics

Transportation And Logistics Car Wash App

Car Wash App Home Services App

Home Services App ERP Development Services

ERP Development Services CMS Development Services

CMS Development Services LMS Development

LMS Development CRM Development

CRM Development DevOps Development Services

DevOps Development Services AI Business Solutions

AI Business Solutions AI Cloud Solutions

AI Cloud Solutions AI Chatbot Development

AI Chatbot Development API Development

API Development Blockchain Product Development

Blockchain Product Development Cryptocurrency Wallet Development

Cryptocurrency Wallet Development About Talentelgia

About Talentelgia  Our Team

Our Team  Our Culture

Our Culture

Healthcare App Development Services

Healthcare App Development Services Real Estate Web Development Services

Real Estate Web Development Services E-Commerce App Development Services

E-Commerce App Development Services E-Commerce Web Development Services

E-Commerce Web Development Services Blockchain E-commerce

Development Company

Blockchain E-commerce

Development Company Fintech App Development Services

Fintech App Development Services Finance Web Development

Finance Web Development Blockchain Fintech

Development Company

Blockchain Fintech

Development Company E-Learning App Development Services

E-Learning App Development Services Restaurant App Development Company

Restaurant App Development Company Mobile Game Development Company

Mobile Game Development Company Travel App Development Company

Travel App Development Company Automotive Web Design

Automotive Web Design AI Traffic Management System

AI Traffic Management System AI Inventory Management Software

AI Inventory Management Software AI Software Development

AI Software Development AI Development Company

AI Development Company ChatGPT integration services

ChatGPT integration services AI Integration Services

AI Integration Services Machine Learning Development

Machine Learning Development Machine learning consulting services

Machine learning consulting services Blockchain Development

Blockchain Development Blockchain Software Development

Blockchain Software Development Smart contract development company

Smart contract development company NFT marketplace development services

NFT marketplace development services IOS App Development

IOS App Development Android App Development

Android App Development Cross-Platform App Development

Cross-Platform App Development Augmented Reality (AR) App

Development

Augmented Reality (AR) App

Development Virtual Reality (VR) App Development

Virtual Reality (VR) App Development Web App Development

Web App Development Flutter

Flutter React

Native

React

Native Swift

(IOS)

Swift

(IOS) Kotlin (Android)

Kotlin (Android) MEAN Stack Development

MEAN Stack Development AngularJS Development

AngularJS Development MongoDB Development

MongoDB Development Nodejs Development

Nodejs Development Database development services

Database development services Ruby on Rails Development services

Ruby on Rails Development services Expressjs Development

Expressjs Development Full Stack Development

Full Stack Development Web Development Services

Web Development Services Laravel Development

Laravel Development LAMP

Development

LAMP

Development Custom PHP Development

Custom PHP Development User Experience Design Services

User Experience Design Services User Interface Design Services

User Interface Design Services Automated Testing

Automated Testing Manual

Testing

Manual

Testing About Talentelgia

About Talentelgia Our Team

Our Team Our Culture

Our Culture

Write us on:

Write us on:  Business queries:

Business queries:  HR:

HR: