According to the Global Economic Forum, FinTech companies are experiencing remarkable success, with customer growth rates averaging over 50%. This growth indicates increasing dependence on technology to revolutionize financial services. From the simplicity of transactions to innovative financial solutions, FinTech has emerged as the bedrock of the modern banking industry.

This raises major questions regarding technological innovations being made in the Fintech industry. When we look at current trends and scenarios, one thing is pretty evident—financial institutions all over the globe are adopting app development to make their financial operations easier, improve the user experience, and increase accessibility. Not only is this improving consumer experience, but it also generates revenue for the sector.

However, all this eventually comes down to a major question, how much does a fintech app development cost? A lot of factors are involved in developing a fintech application. Most things that go into creating a fintech application involve some of the latest technologies like AI, machine learning, and blockchain; so applications can be smooth, secure, and user-friendly. But again, the general cost depends on various factors like features’ complexity, the type of platform on which the application is built, how much it costs in regulatory compliance, and how frequently it requires maintenance.

It is an important factor for businesses to consider the cost dynamics of Fintech app development. Apart from increasing customer satisfaction, a well-designed fintech application can put companies at the helm of the ever-changing digital financial ecosystem to ensure survival in this competitive market.

In this blog, we’ll uncover the cost of building a fintech application, the types of fintech applications, benefits, challenges, and tips to minimize the overall cost.

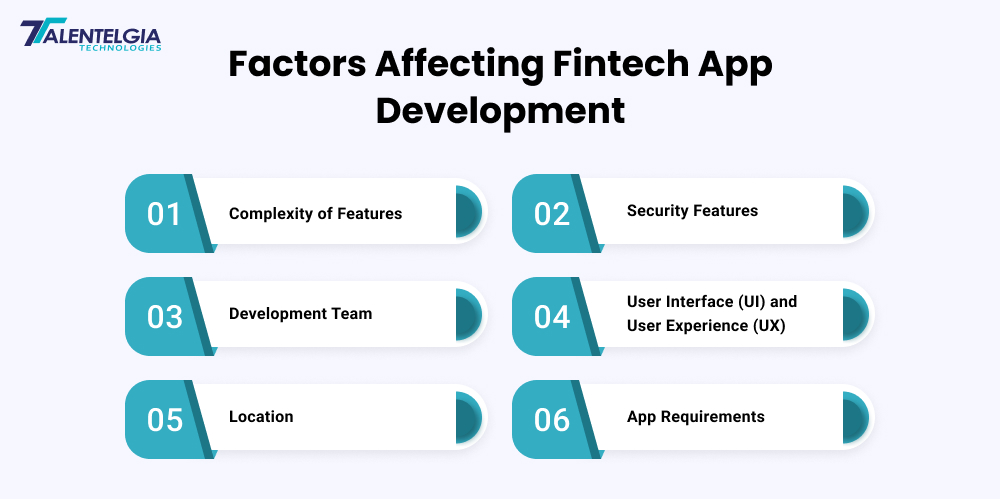

Key Factors Affecting the Cost of a Fintech Application

When we talk about the cost of building a fintech application, it comes with a lot of factors influencing it. Different niches within the fintech sector might have different costs of building the application. Moreover, if you are building a high-end application, it might cost you more than the average fintech application. All in all, factors like budget, app features, and app complexity decide the overall cost of a fintech application.

For example, an InsurTech application might cost anywhere from $50,000 to $500,000 or even more depending on your needs. On the other hand, a PayTech application focused on digital payments with fewer features such as payment processing and security implementation may range from $30,000 to $100,000. The most advanced version may be much higher than $150,000 if it is multi-currency and incorporates AI-driven fraud prevention as well as integrates easily with third-party applications.

Let’s dive deep into the factors to understand it better:

Complexity of Features

The cost of building a fintech application strongly depends on the complexity of the features offered. For example, offering real-time analytics and AI-driven insights will significantly contribute to complexity. More sophisticated functionalities, such as multihub compatibility and complex third-party integrations, drive the overall development effort even higher. Let’s take a closer look at different features and their expected costs.

| Feature Complexity | Description | Estimated Cost ($) |

|---|---|---|

| Basic Features | User registration, fundamental transaction capabilities, and an easy dashboard. | $20,000 – $50,000 |

| Moderate Complexity | Advanced reporting, notifications, and integration with external APIs. | $50,000 – $150,000 |

| Advanced Features | Predictive analytics, AI-based decision-making, and seamless cross-platform usability. | $150,000 – $500,000+ |

Development Team

The second main factor affecting the cost of developing a mobile application is the type of team you hire to develop it. Although you will have a lot of options, your budget and project requirements will set up the course. You can choose between freelance developers, building in-house teams, and outsourcing to a specialized agency of development. Each offers pros and cons.

- Freelancers are sometimes the most cost-effective, although they lack the resources or expertise to complete complex tasks.

- In-house teams can only focus fully on the task due to the costs of employee salaries, infrastructure, and benefits, among others.

- Outsourcing work to agencies provides a middle point, bringing with it tons of expertise and streamlined procedures but requiring higher upfront expenses.

For example, a fintech application developed by a startup for high-security features and AI-based analytics would require highly skilled freelancers, which would not be possible. They can consider hiring a specialized agency providing fintech development to ensure the architecture is strong and also abides by financial regulations. Seeking a professional fintech app development company can help the business make these choices, determining the best way in terms of their objectives and budget.

Security Features

The nature of financial information involved in fintech applications demands high-security protocols to secure trust among users and achieve compliance with regulatory standards. Adding some advanced security features such as fingerprint recognition, end-to-end encryption, and fraud detection enhances the development cost.

| Security Level | Description | Estimated Cost ($) |

| Basic Security | Encrypting data and providing secure logins to avoid unauthorized access. | $10,000 – $30,000 |

| Increased Security | Advanced features like two-factor authentication, encryption protocols, and biometric verification. | $30,000 – $100,000 |

| Highest-Level Security Compliance | Meeting industry standards like PCI DSS, GDPR, or SOC 2, along with advanced fraud prevention technologies. | $100,000+ |

Location

The cost of developing finance applications differs greatly depending on the country in which the development is conducted. Here’s an overview of estimated costs for different types of finance apps across regions. We have taken the USA, Ukraine, and India as references. Kindly note that these are just average costs.

| App Type | USA ($) | Ukraine ($) | India ($) |

| Banking Apps | $500,000 | $175,000 | $105,000 |

| Investment Apps | $180,000 | $60,000 | $30,000 |

| Consumer Finance Apps | $240,000 | $80,000 | $50,000 |

| Insurance Apps | $300,000 | $100,000 | $75,000 |

| Lending Apps | $270,000 | $90,000 | $65,000 |

This difference in cost makes it imperative to select the right location according to your budget and project requirements.

User Interface (UI) and User Experience (UX)

Any fintech application requires a smooth and friendly UI/UX. The development cost of such an interface would vary widely, depending upon the number of modifications that need to be done and the extent of user testing already done.

| Design Type | Cost Range | Description |

|---|---|---|

| Basic Design | $10,000 – $30,000 | Covers fundamental UI/UX elements with standard templates and minimal customization. |

| Customized UI/UX | $30,000 – $100,000 | Involves tailored designs, animations, and interactive features specific to the app’s requirements. |

| Premium Design with User Testing | $100,000+ | Includes high-end, bespoke designs, extensive user testing, and iteration based on feedback. |

App Requirements

The requirements for an app are one of the significant cost influencers in the development of FinTech applications. Two main aspects that impact the cost of your fintech application in terms of app requirements are:

- Scope of Work: This refers to the features and functionalities of a financial application alongside the effort required to develop them. A broader scope of work directly impacts the project size and increases the development hours, ultimately raising the cost.

- Product Complexity refers to the complexity of the idea and logic behind the application. Difficult and elaborate ideas require a lot more work in the development, testing, and launching phases, thereby increasing expenses.

Non-functional requirements also have a significant role to play in development costs. These include attributes such as scalability, security, usability, reliability, and performance, that determine how well the application operates. Since these factors significantly influence user satisfaction, prioritizing them is essential while crafting a high-quality FinTech application.

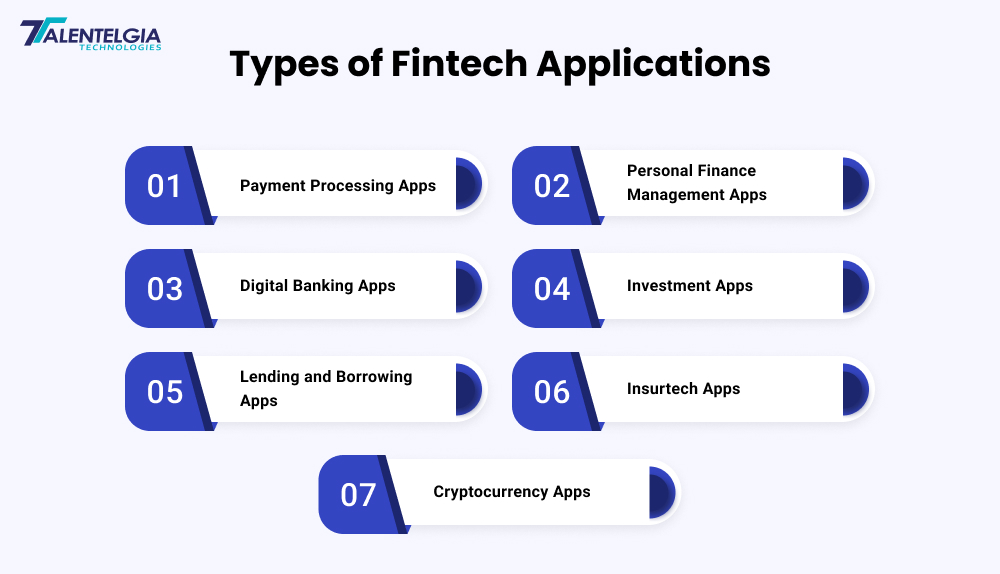

Types of FinTech Applications and Expected Cost

Having a fundamental understanding of the average cost of various fintech applications may be crucial in starting with your fintech app development. The costs are significantly different based on the type of application, features, complexity, and regulatory requirements. Below is an overview of common fintech applications or fintech blockchain app and their estimated development costs:

| App Types | Development Costs |

| Deposit and Lending Apps | $20,000 – $140,000 |

| Digital Banking Apps | $200,000 – $500,000 |

| Insurance (InsurTech) Apps | $2,515 – $23,259 |

| Investment and Wealth Management Apps | $500,000 – $1 million |

| Payment Applications | $50,000 – $100,000 |

| Personal Finance Management Apps | $35,000 – $50,000 |

Benefits of Fintech Applications

1.Increased Security

As people rely on online payment systems more than ever, security becomes one of the top priorities among customers. FinTech solutions offer security over sensitive information that makes a customer confident enough to do his transactions through these apps. They ensure security using measures such as security codes, mobile encryption policies, and secure connections while transmitting personal information. Also, the feature of biometric authentication along with tokenized data increases the level of security to make FinTech apps inevitable for businesses trying to build their customer trust.

2. Increased Speed

Ever wondered how online loan approvals happen within hours? That’s the power of FinTech apps. They enable digital lenders to offer same-day funding, transforming financial services with unprecedented speed. Whether it’s a short-term loan or a payday advance, these platforms simplify and expedite processes, allowing users to access multiple lenders online with ease. Businesses leveraging FinTech solutions save time and improve efficiency, offering a faster alternative to traditional banking methods.

3. Robo Advisors for Smarter Investment

Robo advisors are a pioneering advancement in financial technology that enables a customized investment approach via sophisticated algorithms and individualized questionnaires. The services that the automated advisors offer cost much less than their counterparts, traditional investment consulting. Investing becomes possible for almost anyone with modest capital by leveraging the cost-effective approach of the Robo advisors. Automating all routine tasks frees human professionals to build stronger client relationships and provide a seamless experience to investors.

Challenges of Building a Fintech Application

While the long-term revenue generation from a fintech app can be tremendous, it is important to note that the building and initial phase come with its own set of challenges. Let’s uncover some of these challenges:

1.Regulatory Compliance and security

Fintech applications must fulfill the required regulatory standards as per the regional laws. Compliance with regulations like GDPR and KYC is paramount for obtaining user trust as well as long-term viability.

For instance, in the case of a mobile banking app like Revolut, ensuring identity verification of each user is mandatory. This is done to comply with anti-money laundering laws. Any failure to comply with such laws can lead to potential blockage in the particular region.

2. User Experience and Trust

While building a fintech application, a major focus has to be on maintaining a balance between offering a user-friendly interface and overall functionality. This is because the financial sector is sensitive when it comes to user trust owing to the increasing security breaches.

For instance, applications like Mint or PayPal face challenges like balancing easy user interface with overall app functionality. This is because, if the application’s interface is cluttered, users who are less tech-savvy might get alienated and hesitate to use the application.

3. Integration with Legacy Systems

Most financial firms are still using legacy solutions that were not designed and built to support modern digital alternatives. Integrating new FinTech apps with these would be a technical and logistical challenge, as legacy systems typically are not compatible with contemporary APIs or cloud-based service providers.

For instance, when Chime, a challenger bank, sought to integrate with the traditional banks’ legacy systems, they found it challenging. Since the traditional banks were not designed to communicate with third-party applications, it was tough to link customer accounts to Chime’s platform.

Conclusion

Fintech applications transform how people and businesses communicate with financial systems. The actual process of developing a fintech app is building trust and achieving financial inclusivity, rather than becoming innovative. Solutions that give power to users are not only flexible and transparent but also meaningful-impact solutions that go beyond simple functionality.

As fintech continues to evolve, the focus needs to remain on anticipating future needs, using new emerging technologies, and designing experiences that simplify and enrich financial interactions. This forward-looking approach ensures that fintech applications remain relevant and invaluable in an ever-changing digital economy.

Frequently Asked Questions (FAQs)

How long does it take to develop a fintech app?

A simple application may take about 3-6 months. If you are building something more complex, it may take 6-12 months or more.

Are post-launch updates possible for a fintech app?

Yes, we give support for updates. The periods may include performance improvements, security patches, and new features.

Healthcare App Development Services

Healthcare App Development Services

Real Estate Web Development Services

Real Estate Web Development Services

E-Commerce App Development Services

E-Commerce App Development Services E-Commerce Web Development Services

E-Commerce Web Development Services Blockchain E-commerce Development Company

Blockchain E-commerce Development Company

Fintech App Development Services

Fintech App Development Services Fintech Web Development

Fintech Web Development Blockchain Fintech Development Company

Blockchain Fintech Development Company

E-Learning App Development Services

E-Learning App Development Services

Restaurant App Development Company

Restaurant App Development Company

Mobile Game Development Company

Mobile Game Development Company

Travel App Development Company

Travel App Development Company

Automotive Web Design

Automotive Web Design

AI Traffic Management System

AI Traffic Management System

AI Inventory Management Software

AI Inventory Management Software

AI Software Development

AI Software Development  AI Development Company

AI Development Company  AI App Development Services

AI App Development Services  ChatGPT integration services

ChatGPT integration services  AI Integration Services

AI Integration Services  Generative AI Development Services

Generative AI Development Services  Natural Language Processing Company

Natural Language Processing Company Machine Learning Development

Machine Learning Development  Machine learning consulting services

Machine learning consulting services  Blockchain Development

Blockchain Development  Blockchain Software Development

Blockchain Software Development  Smart Contract Development Company

Smart Contract Development Company  NFT Marketplace Development Services

NFT Marketplace Development Services  Asset Tokenization Company

Asset Tokenization Company DeFi Wallet Development Company

DeFi Wallet Development Company Mobile App Development

Mobile App Development  IOS App Development

IOS App Development  Android App Development

Android App Development  Cross-Platform App Development

Cross-Platform App Development  Augmented Reality (AR) App Development

Augmented Reality (AR) App Development  Virtual Reality (VR) App Development

Virtual Reality (VR) App Development  Web App Development

Web App Development  SaaS App Development

SaaS App Development Flutter

Flutter  React Native

React Native  Swift (IOS)

Swift (IOS)  Kotlin (Android)

Kotlin (Android)  Mean Stack Development

Mean Stack Development  AngularJS Development

AngularJS Development  MongoDB Development

MongoDB Development  Nodejs Development

Nodejs Development  Database Development

Database Development Ruby on Rails Development

Ruby on Rails Development Expressjs Development

Expressjs Development  Full Stack Development

Full Stack Development  Web Development Services

Web Development Services  Laravel Development

Laravel Development  LAMP Development

LAMP Development  Custom PHP Development

Custom PHP Development  .Net Development

.Net Development  User Experience Design Services

User Experience Design Services  User Interface Design Services

User Interface Design Services  Automated Testing

Automated Testing  Manual Testing

Manual Testing  Digital Marketing Services

Digital Marketing Services

Ride-Sharing And Taxi Services

Ride-Sharing And Taxi Services Food Delivery Services

Food Delivery Services Grocery Delivery Services

Grocery Delivery Services Transportation And Logistics

Transportation And Logistics Car Wash App

Car Wash App Home Services App

Home Services App ERP Development Services

ERP Development Services CMS Development Services

CMS Development Services LMS Development

LMS Development CRM Development

CRM Development DevOps Development Services

DevOps Development Services AI Business Solutions

AI Business Solutions AI Cloud Solutions

AI Cloud Solutions AI Chatbot Development

AI Chatbot Development API Development

API Development Blockchain Product Development

Blockchain Product Development Cryptocurrency Wallet Development

Cryptocurrency Wallet Development About Talentelgia

About Talentelgia  Our Team

Our Team  Our Culture

Our Culture

Healthcare App Development Services

Healthcare App Development Services Real Estate Web Development Services

Real Estate Web Development Services E-Commerce App Development Services

E-Commerce App Development Services E-Commerce Web Development Services

E-Commerce Web Development Services Blockchain E-commerce

Development Company

Blockchain E-commerce

Development Company Fintech App Development Services

Fintech App Development Services Finance Web Development

Finance Web Development Blockchain Fintech

Development Company

Blockchain Fintech

Development Company E-Learning App Development Services

E-Learning App Development Services Restaurant App Development Company

Restaurant App Development Company Mobile Game Development Company

Mobile Game Development Company Travel App Development Company

Travel App Development Company Automotive Web Design

Automotive Web Design AI Traffic Management System

AI Traffic Management System AI Inventory Management Software

AI Inventory Management Software AI Software Development

AI Software Development AI Development Company

AI Development Company ChatGPT integration services

ChatGPT integration services AI Integration Services

AI Integration Services Machine Learning Development

Machine Learning Development Machine learning consulting services

Machine learning consulting services Blockchain Development

Blockchain Development Blockchain Software Development

Blockchain Software Development Smart contract development company

Smart contract development company NFT marketplace development services

NFT marketplace development services IOS App Development

IOS App Development Android App Development

Android App Development Cross-Platform App Development

Cross-Platform App Development Augmented Reality (AR) App

Development

Augmented Reality (AR) App

Development Virtual Reality (VR) App Development

Virtual Reality (VR) App Development Web App Development

Web App Development Flutter

Flutter React

Native

React

Native Swift

(IOS)

Swift

(IOS) Kotlin (Android)

Kotlin (Android) MEAN Stack Development

MEAN Stack Development AngularJS Development

AngularJS Development MongoDB Development

MongoDB Development Nodejs Development

Nodejs Development Database development services

Database development services Ruby on Rails Development services

Ruby on Rails Development services Expressjs Development

Expressjs Development Full Stack Development

Full Stack Development Web Development Services

Web Development Services Laravel Development

Laravel Development LAMP

Development

LAMP

Development Custom PHP Development

Custom PHP Development User Experience Design Services

User Experience Design Services User Interface Design Services

User Interface Design Services Automated Testing

Automated Testing Manual

Testing

Manual

Testing About Talentelgia

About Talentelgia Our Team

Our Team Our Culture

Our Culture

Write us on:

Write us on:  Business queries:

Business queries:  HR:

HR: