The rise of mobile wallet apps has changed the way people go about their finances; these offer an innovative, fast, and secure alternative to cash or cards. As people get used to cashless transactions globally, such applications have emerged as a crucial tool to manage money in a world where digital comes first.

Experts predict that mobile wallets are expected to grow at over 15 % per year from $1.04 trillion in 2020 to $7.58 trillion by 2027.

That is because of seamless payments and robust security measures. This has made mobile wallets not only safer but also far more efficient than ever.

However, digital wallet app development is not an easy feat. It requires a combination of advanced technology and a strategic approach for feature-rich, secure, and user-friendly platforms. In this fast-growing domain, the business needs to consider carefully all the factors including expectations from users, market competition, and technical complexities.

This blog explores everything you should know to create a successful digital wallet from essential features and technologies to development costs and step-by-step processes. Be you an entrepreneur or a beginner with the concept, this article is the one-stop resource for you to build an innovative eWallet application that meets modern consumers’ requirements.

Why Now is the Best Time for Digital Wallet App Development?

Digital Wallet Apps, or eWallets, are secure software for storing, sending, and managing money electronically. Unlike traditional wallets, these fintech apps eliminate the need for cash or cards. They offer functions like instant payments, peer-to-peer transfers, and loyalty integrations.

Apps such as Google Pay, Venmo, and PayPal have changed user preferences by allowing users to pay with only one tap or click. These ensure user convenience and security.

An eWallet boosts consumer satisfaction and improves loyalty by streamlining payments.

Accelerated cashless transactions result from technological advancements and evolving consumer needs. Mobile wallets have become a necessary part of the business, pushing contactless payments as smartphones penetrate the global population.

At Talentelgia Technologies, we understand the transformative impact of digital wallet app development. So check out this guide about how business entrepreneurs can capitalize on this trend and make robust, feature-packed digital wallets that stand out.

- Smartphone Dominance: With over 85% of Americans owning a smartphone, mobile apps are the go-to platform for managing finances.

- Increasing Adoption of Online Transactions: Digital wallet penetration is also extending from in-app and online strongholds into in-store purchases, with in-store adoption increasing from 19 percent in 2019 to 28 percent in 2024.

- Diverse uses: Over 70% of people said they would make digital wallets their primary method for shopping, while another 62% said they would for travel.

Cost of Developing a Digital Wallet

The cost depends on the complexity of the application, the features to be included, the type of platform for which it is being built (iOS, Android, or both), and the location in which it is being developed. An average simple mobile wallet application might cost between $30,000 and $50,000. Further, the most advanced apps with real-time notifications, AI-powered analytics, and other kinds of security measures may even cost $70,000 to $150,000 or even more.

However, whether it be an in-house development, outsourcing it to a specialized agency, or even buying a pre-built solution is a costlier factor. Being faster and less costly are the benefits of pre-built solutions. However, in business lines with very specific needs, much more flexibility and scalability occur in custom applications, that’s why it is pretty useful.

With excellent quality digital wallet applications that would meet the expectations of their customers, regulatory requirements, and security standards, the long-run cost will pay for it.

Also Read: Mobile App Development Cost

Technologies Used to Develop a Digital Wallet

A digital wallet app development requires a mix of technologies, ensuring smooth functionality, robust security, and great user experience. The digital wallet contains sensitive financial data; therefore, the technologies employed must enhance usability and provide security against possible threats during transactions.

This means that a successful digital wallet depends on a combination of the right programming languages, frameworks, and tools that are suited to the needs of the app. All the above technologies form the foundation for the app, letting it run smoothly and being reliable.

Developers build solutions that enable scaling and achieve both user expectations as well as those of the regulation requirements implemented across fraud prevention:

Key Technologies Used For Developing Digital Wallet Apps

- Key Programming: Swift and Kotlin for native development or React Native and Flutter for cross-platform compatibility.

- Payment Gateways: Integration with APIs like PayPal, Stripe, or Razorpay for seamless payment processing.

- Data Encryption: Technologies like AES or RSA encryption to safeguard sensitive user information.

- Cloud Services: AWS or Google Cloud for scalable backend infrastructure.

- AI and ML: For personalized user experiences, fraud detection, and transaction analytics.

- Biometric Authentication: Face ID or fingerprint recognition to enhance app security.

- Each technology was chosen to support your app goals, ensuring functionality, scalability, and top-notch user experience.

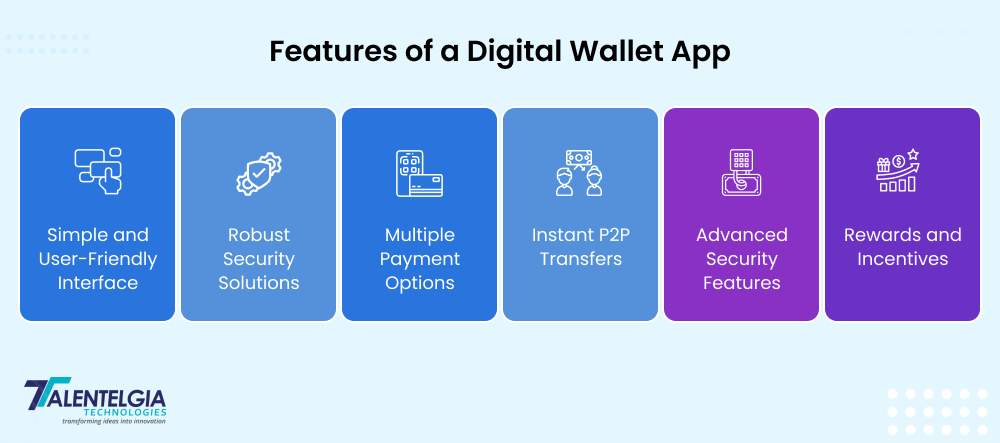

Essential Features of a Digital Wallet App

Creating a successful eWallet app is not just about basic functionality. Modern users expect innovative features that combine ease of use, security, and added value. So, here are the essential features every digital wallet app should include:

1. Simple and User-Friendly Interface

An intriguing interface is the basic requirement of a successful digital wallet app. The simplicity of functionality is the key to an enhanced user experience that helps your brand.

Clear, precise, and concise menu navigation increases user engagement. In addition, optimized performance with a responsive design that functions well on different screen sizes and resolutions makes it accessible across more devices.

2. Robust Security Solutions

The first building block of the digital finance sector is security. Ensuring the safety of user funds and data falls into this category. Strong authentication like multi-factor authentication or biometric verification also provides added security.

Furthermore, advanced fraud detection systems in conjunction with regular security audits will identify potential threats and mitigate them. Educating the users through tips on how to create strong passwords and how to avoid phishing attacks can empower the users to protect themselves and their trust in your brand.

3. Multiple Payment Options

Multiple payment options can help you to attract and retain a diversified user base.

Digital wallet apps like Apple Pay, Google Pay, and Samsung Pay make the payment process easier. This will give room to users making payments using their significant credit and debit cards on major networks, like Mastercard, Visa, or American Express, for increased versatility.

Direct transfers are possible from the app directly into any bank account. Apart from that, support for QR code-based payments and mobile money is ideal for outreach.

4. Instant P2P Transfers

Digital wallet apps feature seamless and instant peer-to-peer (P2P) transfers as one of the core features.

These need features like automatically syncing contacts from the user’s device, and easy transfers between friends, family, and other users. Real-time notifications for successful and failed transfers also keep the users informed. Additionally, a detailed history of transactions with filters and quick search options will help track spending better.

5. Advanced Security Features

Security features are important to ensure the safety of user money and data.

End-to-end encryption keeps data safe throughout the transaction.

Advanced fraud detection tools help to identify and prevent fraudulent activities like unauthorized transactions or identity theft. Users are alerted to suspicious activities like unauthorized login attempts or unusual spending patterns in real time.

Additional security measures like transactional limits, and verification codes add more security to the app.

6. Rewards and Incentives

Use different types of rewards and incentives to encourage the use and retention of digital wallet applications.

A cash-back reward on purchases made through the application is one of the most commonly offered. Rewarding users with points or discount programs for frequent use encourages more usage.

Exclusive deals and promotions, in partnership with merchants, are also great rewards. They can attract new users and retain existing ones. Referral bonuses can also be an incentive to grow the user base. Challenges and badges can gamify actions and motivate users to perform certain actions and gain rewards.

Steps to Build a Digital Wallet App

Digital wallet app development is a multi-step process that requires strategic planning and execution. With these steps, business owners can ensure their apps meet market demands:

Creating a digital wallet application requires more than writing lines of code-it’s an initiative that merges strategy, technology, and user-centered design. Each step leads the final product to achieve all what market demands, including user satisfaction. Below is the road map that will lead companies through building a successful digital wallet application.

1. Market Research

Market research forms the basis of a successful app. Understanding the needs and preferences of the target audience helps identify their pain points, preferences, and expectations. Look into competitor apps to see where their users value the most and how to be different.

With user surveys, focus groups, or analytics, businesses can drive data-informed decisions based on design and functionality. Research also determines the geo-market you wish to target or if certain regulations apply. Finally, market research ensures that every aspect aligns with what users need and expect.

2. Select the Right Technology

The right choice of the technology stack is of extreme importance in building a scalable, secure, and efficient app. Technology is selected based on factors like the complexity of the app, target audience, and desired features. For instance, blockchain may add security, and AI can offer personalized recommendations.

Consider whether the app should be native, hybrid, or cross-platform app depending on your users’ preferred devices. Ensure that the technology stack is adequate to keep future updates and capable of integration with other systems – for example, payment gateways and third-party services- by partnering with experienced developers.

3. Design an Intuitive Interface

It is the major determinant of user satisfaction with your app. An intuitive interface allows first-time users to easily find their way around. Hire professional designers to craft an interface that’s functional but still visually appealing.

Consider adding features like guided onboarding for new users, a clean layout with logical menus, and prominent placement of frequently used functions. Accessibility is equally important, so ensure the app supports users with different needs. A well-thought-out design reduces user friction and encourages long-term engagement.

4. Develop Core Features

Focus on core features like secure transactions, real-time transfer, and history of transactions. To stand out in the crowded marketplace, gradually implement advanced functionalities, such as loyalty rewards, QR-based transactions, and splitting of bills features.

Additionally, ensure the app supports multiple payment options, including bank accounts, credit cards, AI integration, and third-party integrations. Prioritize security by implementing end-to-end encryption and secure login features from the start. Building robust core features sets the stage for user trust and app reliability.

5. Test and Refine

Testing is a critical phase to check that the app works perfectly under different scenarios. Conduct rigorous quality assurance tests. Identify and fix bugs or usability problems before the app reaches users, including functional testing, security checking, and performance analysis.

Beta testing is an excellent way to gather feedback from a controlled group of users. This feedback highlights areas for improvement, such as navigation challenges or missing features. Regular updates based on user input can significantly enhance the overall experience and ensure the app exceeds expectations.

6. Launch and Promote

A successful launch requires more than simply publishing the app on app stores. A viable marketing strategy will ensure your app reaches the right audience and starts gaining traction quickly. Awareness creation can be done by using a mix of channels, including social media, email campaigns, and partnerships.

Highlight the unique features through promotional materials and user testimonials. Offering introductory rewards can encourage downloads and build initial engagement. After launch, monitor the user reviews and analytics to identify opportunities for future updates and improvements.

Conclusion

Digital wallets have changed financial transactions. Investment in eWallet app development will bring more users to a business and drive growth.

By focusing on security, functionality, and user experience, businesses can make applications stand out. At Talentelgia Technologies, our expertise lies in building secure, rich feature digital wallet apps tailored to fit your business needs. It brings a deep understanding of compliance, advanced security features, and user-centric designs, all coming from vast experience in finance app development services.

Healthcare App Development Services

Healthcare App Development Services

Real Estate Web Development Services

Real Estate Web Development Services

E-Commerce App Development Services

E-Commerce App Development Services E-Commerce Web Development Services

E-Commerce Web Development Services Blockchain E-commerce Development Company

Blockchain E-commerce Development Company

Fintech App Development Services

Fintech App Development Services Fintech Web Development

Fintech Web Development Blockchain Fintech Development Company

Blockchain Fintech Development Company

E-Learning App Development Services

E-Learning App Development Services

Restaurant App Development Company

Restaurant App Development Company

Mobile Game Development Company

Mobile Game Development Company

Travel App Development Company

Travel App Development Company

Automotive Web Design

Automotive Web Design

AI Traffic Management System

AI Traffic Management System

AI Inventory Management Software

AI Inventory Management Software

AI Software Development

AI Software Development  AI Development Company

AI Development Company  AI App Development Services

AI App Development Services  ChatGPT integration services

ChatGPT integration services  AI Integration Services

AI Integration Services  Generative AI Development Services

Generative AI Development Services  Natural Language Processing Company

Natural Language Processing Company Machine Learning Development

Machine Learning Development  Machine learning consulting services

Machine learning consulting services  Blockchain Development

Blockchain Development  Blockchain Software Development

Blockchain Software Development  Smart Contract Development Company

Smart Contract Development Company  NFT Marketplace Development Services

NFT Marketplace Development Services  Asset Tokenization Company

Asset Tokenization Company DeFi Wallet Development Company

DeFi Wallet Development Company Mobile App Development

Mobile App Development  IOS App Development

IOS App Development  Android App Development

Android App Development  Cross-Platform App Development

Cross-Platform App Development  Augmented Reality (AR) App Development

Augmented Reality (AR) App Development  Virtual Reality (VR) App Development

Virtual Reality (VR) App Development  Web App Development

Web App Development  SaaS App Development

SaaS App Development Flutter

Flutter  React Native

React Native  Swift (IOS)

Swift (IOS)  Kotlin (Android)

Kotlin (Android)  Mean Stack Development

Mean Stack Development  AngularJS Development

AngularJS Development  MongoDB Development

MongoDB Development  Nodejs Development

Nodejs Development  Database Development

Database Development Ruby on Rails Development

Ruby on Rails Development Expressjs Development

Expressjs Development  Full Stack Development

Full Stack Development  Web Development Services

Web Development Services  Laravel Development

Laravel Development  LAMP Development

LAMP Development  Custom PHP Development

Custom PHP Development  .Net Development

.Net Development  User Experience Design Services

User Experience Design Services  User Interface Design Services

User Interface Design Services  Automated Testing

Automated Testing  Manual Testing

Manual Testing  Digital Marketing Services

Digital Marketing Services

Ride-Sharing And Taxi Services

Ride-Sharing And Taxi Services Food Delivery Services

Food Delivery Services Grocery Delivery Services

Grocery Delivery Services Transportation And Logistics

Transportation And Logistics Car Wash App

Car Wash App Home Services App

Home Services App ERP Development Services

ERP Development Services CMS Development Services

CMS Development Services LMS Development

LMS Development CRM Development

CRM Development DevOps Development Services

DevOps Development Services AI Business Solutions

AI Business Solutions AI Cloud Solutions

AI Cloud Solutions AI Chatbot Development

AI Chatbot Development API Development

API Development Blockchain Product Development

Blockchain Product Development Cryptocurrency Wallet Development

Cryptocurrency Wallet Development About Talentelgia

About Talentelgia  Our Team

Our Team  Our Culture

Our Culture

Healthcare App Development Services

Healthcare App Development Services Real Estate Web Development Services

Real Estate Web Development Services E-Commerce App Development Services

E-Commerce App Development Services E-Commerce Web Development Services

E-Commerce Web Development Services Blockchain E-commerce

Development Company

Blockchain E-commerce

Development Company Fintech App Development Services

Fintech App Development Services Finance Web Development

Finance Web Development Blockchain Fintech

Development Company

Blockchain Fintech

Development Company E-Learning App Development Services

E-Learning App Development Services Restaurant App Development Company

Restaurant App Development Company Mobile Game Development Company

Mobile Game Development Company Travel App Development Company

Travel App Development Company Automotive Web Design

Automotive Web Design AI Traffic Management System

AI Traffic Management System AI Inventory Management Software

AI Inventory Management Software AI Software Development

AI Software Development AI Development Company

AI Development Company ChatGPT integration services

ChatGPT integration services AI Integration Services

AI Integration Services Machine Learning Development

Machine Learning Development Machine learning consulting services

Machine learning consulting services Blockchain Development

Blockchain Development Blockchain Software Development

Blockchain Software Development Smart contract development company

Smart contract development company NFT marketplace development services

NFT marketplace development services IOS App Development

IOS App Development Android App Development

Android App Development Cross-Platform App Development

Cross-Platform App Development Augmented Reality (AR) App

Development

Augmented Reality (AR) App

Development Virtual Reality (VR) App Development

Virtual Reality (VR) App Development Web App Development

Web App Development Flutter

Flutter React

Native

React

Native Swift

(IOS)

Swift

(IOS) Kotlin (Android)

Kotlin (Android) MEAN Stack Development

MEAN Stack Development AngularJS Development

AngularJS Development MongoDB Development

MongoDB Development Nodejs Development

Nodejs Development Database development services

Database development services Ruby on Rails Development services

Ruby on Rails Development services Expressjs Development

Expressjs Development Full Stack Development

Full Stack Development Web Development Services

Web Development Services Laravel Development

Laravel Development LAMP

Development

LAMP

Development Custom PHP Development

Custom PHP Development User Experience Design Services

User Experience Design Services User Interface Design Services

User Interface Design Services Automated Testing

Automated Testing Manual

Testing

Manual

Testing About Talentelgia

About Talentelgia Our Team

Our Team Our Culture

Our Culture

Write us on:

Write us on:  Business queries:

Business queries:  HR:

HR: