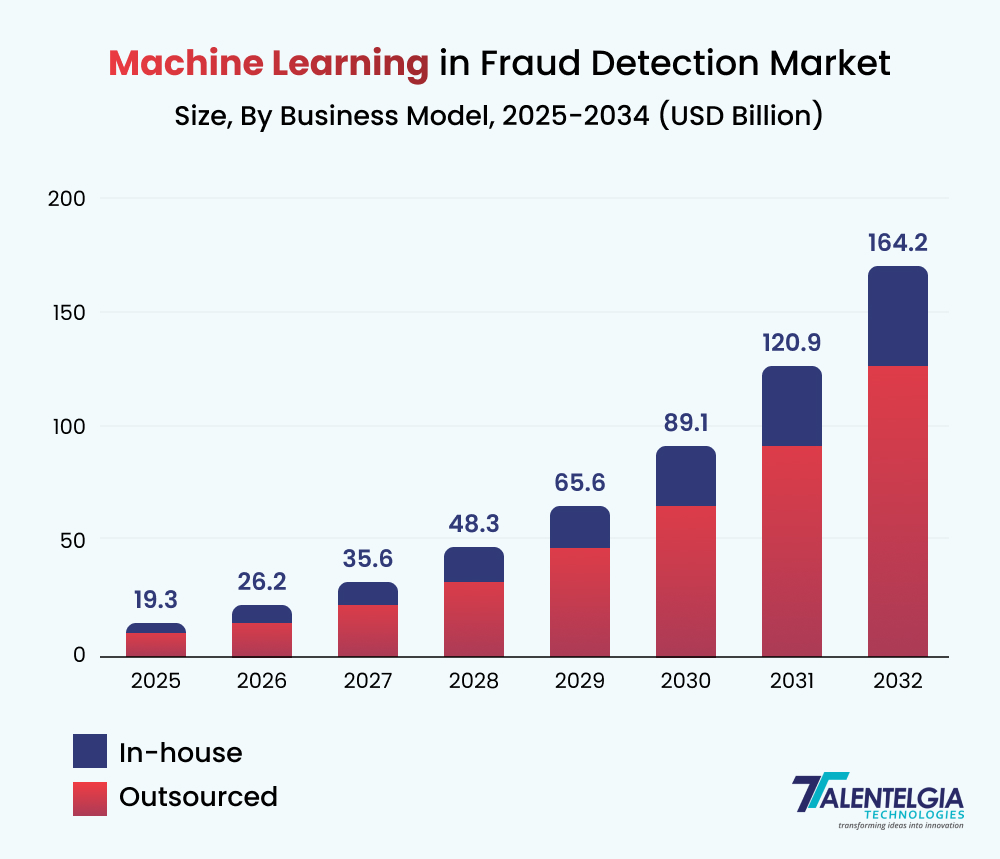

A growing number of instances of fraudulent use of credit cards are alarming for both companies and individual customers. This high volume of online transactions is increasing the demand for credit card fraud detection systems.

Moreover, advanced techniques of using credit card fraud also limit the use of conventional methods to detect this cybercrime. This makes using machine learning development services for the detection of fraud for credit cards the right solution. Read below to find out more about it:

What Is Credit Card Fraud Detection?

Credit card fraud detection refers to identifying fraudulent or unauthorized transactions made through a credit card. Fraud may be in the form of unauthorized charges, identity theft, and account takeovers. The sooner they are detected, the lesser the financial loss and the more protection for customer trust.

If you are a business looking to build a credit card fraud detection system using machine learning to keep your users safe, you are at the right place. Let us discuss how the latest technologies can help you protect customer data.

Role of Machine Learning in Credit Card Fraud Detection

Machine learning is a part of AI development. It enables systems to learn through experiences and improve themselves over time without having them programmed for the same.

Therefore, using machine learning in the detection of credit card fraud is a great move. It analyzes the historical data regarding the transactions and brings into light any patterns and anomalies that come along with fraudulent activities.

Let us look at how machine learning revolutionizes fraud detection work. It will explain its role in real-time detection, accuracy enhancement, and how it adapts to changing fraud tactics.

1. Real-Time Detection

The machine learning model can process enormous amounts of transaction data in real time. Therefore, fraudulent activities are flagged in real-time. This reduces the loss of money through fraud and maximizes customer safety.

2. Increased Accuracy

Credit Card Fraud Detection systems can identify even the slightest patterns that other systems may not recognize with historical data. This minimizes false positives and negatives.

3. Flexibility

The strategies of the fraudsters may change. Therefore all of the models of machine learning need learning capabilities. This helps them retrain on new data.

4. Scalability

Credit card fraud detection using machine learning scales seamlessly to your business needs. This could be tens of thousands, hundreds, or millions of transactions per day.

Core Machine Learning Technologies in Credit Card Fraud Detection Systems

Machine learning is a robust technology. This makes it important to understand the machine learning technologies helpful in developing fraud detection systems in credit cards. We have briefly described some of these below:

1. Supervised Learning

This method utilizes only labeled data, such as fraud versus valid transactions, to train the models. The popular algorithms used are logistic regression, SVM, and random forests.

2. Unsupervised Learning

These are used when the available amount of labeled data is less. Similar transactions can be grouped by clustering algorithms like K-means and DBSCAN. It is helpful in the anomaly detection scenario.

3. Deep Learning

It is noticed that deep learning models, such as neural networks, can easily tackle complex data. CNN and RNN are two of the widely used ML techniques for fraud detection.

4. Hybrid Models

Hybrid models are the ones in which more than one machine learning technique is used to make the detection as accurate as possible. For example, unsupervised learning identifies anomalies; later, these detected anomalies can be classified through a supervised model.

Steps to Design a Credit Card Fraud Detection System

Creating an effective credit card fraud detection system using machine learning involves a systematic process. In this section, we’ll break down the key steps, providing insights into best practices and tools used at each stage.

1. Data Collection

Gather transaction data, such as the transaction amount, location, time, and merchant details. For preliminary testing, one typically uses public datasets like the Kaggle Credit Card Fraud Detection dataset.

2. Data Preprocessing

Clean the dataset – remove missing values, outliers, and noise; normalize numerical features and encode categorical variables for modeling.

3. Feature Engineering

Identify features that have the highest influence on fraud detection. These are velocity, frequency, and location. Good feature engineering is the way to better performance.

4. Model Training

Split data into training and testing subsets. Then, train machine learning models on the former and hyperparameters to get the best possible performance.

5. Model Evaluation

The model shall be tested through accuracy, precision, recall, and F1-score. There should be a balance between fraud detection and false positives.

6. Deployment

Implement the trained model in your transaction processing system and monitor its performance. Retrain it periodically by adding new data to keep the model accurate.

Why Machine Learning for Fraud Detection?

Investment in a credit card fraud detection system is an excellent strategic decision for businesses dealing with credit card transactions. There are several benefits of investing in credit card fraud detection based on machine learning. Some of these include:

1. Better Safety: The complex security algorithms can easily detect frauds that the basic systems would not identify.

2. Low Cost: The saving of loss and the money saved would save the overhead expense of operation at the time when a dispute resolution is made.

3. Customer Trust: Secure transactions enhance customer satisfaction and loyalty to the business.

4. Effectiveness: A fraud detection system reduces the manual review teams and allows them to focus on complicated cases.

Difficulties in Using Machine Learning for Fraud Detection

| Step | Best Practices | Tools |

|---|---|---|

| Data Collection | Gather diverse transaction data (amount, location, time, merchant, etc.). Utilize public datasets like the Kaggle Credit Card Fraud Detection dataset for initial testing. | Data mining tools, APIs, web scraping libraries |

| Data Preprocessing | Clean the dataset by handling missing values, and removing outliers and noise. Normalize numerical features and encode categorical variables. | Pandas, Scikit-learn preprocessing functions |

| Feature Engineering | Identify and engineer relevant features (velocity, frequency, location) to improve model accuracy. | Feature selection algorithms, domain expertise |

| Model Training | Split data into training and testing sets. Train various machine learning models (e.g., logistic regression, decision trees, neural networks) and fine-tune hyperparameters for optimal performance. | Scikit-learn, TensorFlow, PyTorch |

| Model Evaluation | Evaluate model performance using metrics like accuracy, precision, recall, and F1-score. Balance fraud detection with minimizing false positives. | Confusion matrix, ROC curve, AUC score |

| Deployment | Deploy the trained model into the transaction processing system. Continuously monitor performance and retrain the model periodically with new data. | Cloud platforms (AWS, Azure, GCP), model deployment tools (Flask, Docker) |

Strategic planning is helpful to address the challenges businesses face when implementing machine learning for fraud detection. However, it is necessary to follow the right steps to overcome these obstacles and ensure successful system deployment.

1. Imbalanced Data

Frauds are not as frequent as actual transactions this to biased datasets. The above problems can be overcome by oversampling and synthetic data generation.

2. Data Privacy

As the system deals with sensitive financial data, it has the highest compliance with data privacy regulations, like GDPR and PCI DSS.

3. Model Interpretability

Machine learning models that are by nature complex, such as deep learning, may sometimes be uninterpretable. Decisions may not always be explained to the stakeholders easily.

4. Continuous Learning

The tactics of credit card fraud change continuously. Thus, models need continuous retraining and updating.

Real-world Applications of Credit Card Fraud Detection Systems

Credit card fraud detection systems are particularly gaining popularity in fintech app development. There are many examples of how companies within any industry leverage machine learning-based credit card fraud detection systems. Read below to find out its real-world applications and use cases.

1. Banks and Financial Institutions: The machine learning model is implemented to track bank customers’ transactions. It blocks suspicious transactions in real time.

2. E-commerce Platforms: It also helps online merchants detect fraudulent orders and avoid chargebacks.

3. Payment Gateways: PayPal and Stripe payment processors make use of the power of the latest machine learning algorithms to ensure the safety of transactions with security on the users’ accounts.

Why Choose Us for Machine Learning Development?

Our team specializes in the development of machine learning and AI business solutions. We offer customized solutions for your business needs. We deliver top-notch services with:

- Tailored Solution: We offer a custom fraud detection system that suits your business needs.

- Expert Team: We have expertise in fraud detection system development, making us the best partner for your security with our cybersecurity services.

- Support Continuity: From deployment to maintenance, we will ensure that your system continues working effectively over time.

Conclusion

Credit card fraud is a critical problem, but machine learning offers an effective solution. Credit card fraud detection using machine learning can significantly enhance security. This also reduces financial loss and builds up customer trust among businesses.

Whether you’re a financial institution or an e-commerce platform, implementing a machine learning-powered fraud detection system is important for safeguarding your operations. Partner with us to develop a state-of-the-art system that meets your unique needs and stays ahead of fraudsters.

You can Also Read:

Importance Of Cybersecurity In the Financial Industry

Healthcare App Development Services

Healthcare App Development Services

Real Estate Web Development Services

Real Estate Web Development Services

E-Commerce App Development Services

E-Commerce App Development Services E-Commerce Web Development Services

E-Commerce Web Development Services Blockchain E-commerce Development Company

Blockchain E-commerce Development Company

Fintech App Development Services

Fintech App Development Services Fintech Web Development

Fintech Web Development Blockchain Fintech Development Company

Blockchain Fintech Development Company

E-Learning App Development Services

E-Learning App Development Services

Restaurant App Development Company

Restaurant App Development Company

Mobile Game Development Company

Mobile Game Development Company

Travel App Development Company

Travel App Development Company

Automotive Web Design

Automotive Web Design

AI Traffic Management System

AI Traffic Management System

AI Inventory Management Software

AI Inventory Management Software

AI Software Development

AI Software Development  AI Development Company

AI Development Company  AI App Development Services

AI App Development Services  ChatGPT integration services

ChatGPT integration services  AI Integration Services

AI Integration Services  Generative AI Development Services

Generative AI Development Services  Natural Language Processing Company

Natural Language Processing Company Machine Learning Development

Machine Learning Development  Machine learning consulting services

Machine learning consulting services  Blockchain Development

Blockchain Development  Blockchain Software Development

Blockchain Software Development  Smart Contract Development Company

Smart Contract Development Company  NFT Marketplace Development Services

NFT Marketplace Development Services  Asset Tokenization Company

Asset Tokenization Company DeFi Wallet Development Company

DeFi Wallet Development Company Mobile App Development

Mobile App Development  IOS App Development

IOS App Development  Android App Development

Android App Development  Cross-Platform App Development

Cross-Platform App Development  Augmented Reality (AR) App Development

Augmented Reality (AR) App Development  Virtual Reality (VR) App Development

Virtual Reality (VR) App Development  Web App Development

Web App Development  SaaS App Development

SaaS App Development Flutter

Flutter  React Native

React Native  Swift (IOS)

Swift (IOS)  Kotlin (Android)

Kotlin (Android)  Mean Stack Development

Mean Stack Development  AngularJS Development

AngularJS Development  MongoDB Development

MongoDB Development  Nodejs Development

Nodejs Development  Database Development

Database Development Ruby on Rails Development

Ruby on Rails Development Expressjs Development

Expressjs Development  Full Stack Development

Full Stack Development  Web Development Services

Web Development Services  Laravel Development

Laravel Development  LAMP Development

LAMP Development  Custom PHP Development

Custom PHP Development  .Net Development

.Net Development  User Experience Design Services

User Experience Design Services  User Interface Design Services

User Interface Design Services  Automated Testing

Automated Testing  Manual Testing

Manual Testing  Digital Marketing Services

Digital Marketing Services

Ride-Sharing And Taxi Services

Ride-Sharing And Taxi Services Food Delivery Services

Food Delivery Services Grocery Delivery Services

Grocery Delivery Services Transportation And Logistics

Transportation And Logistics Car Wash App

Car Wash App Home Services App

Home Services App ERP Development Services

ERP Development Services CMS Development Services

CMS Development Services LMS Development

LMS Development CRM Development

CRM Development DevOps Development Services

DevOps Development Services AI Business Solutions

AI Business Solutions AI Cloud Solutions

AI Cloud Solutions AI Chatbot Development

AI Chatbot Development API Development

API Development Blockchain Product Development

Blockchain Product Development Cryptocurrency Wallet Development

Cryptocurrency Wallet Development About Talentelgia

About Talentelgia  Our Team

Our Team  Our Culture

Our Culture

Healthcare App Development Services

Healthcare App Development Services Real Estate Web Development Services

Real Estate Web Development Services E-Commerce App Development Services

E-Commerce App Development Services E-Commerce Web Development Services

E-Commerce Web Development Services Blockchain E-commerce

Development Company

Blockchain E-commerce

Development Company Fintech App Development Services

Fintech App Development Services Finance Web Development

Finance Web Development Blockchain Fintech

Development Company

Blockchain Fintech

Development Company E-Learning App Development Services

E-Learning App Development Services Restaurant App Development Company

Restaurant App Development Company Mobile Game Development Company

Mobile Game Development Company Travel App Development Company

Travel App Development Company Automotive Web Design

Automotive Web Design AI Traffic Management System

AI Traffic Management System AI Inventory Management Software

AI Inventory Management Software AI Software Development

AI Software Development AI Development Company

AI Development Company ChatGPT integration services

ChatGPT integration services AI Integration Services

AI Integration Services Machine Learning Development

Machine Learning Development Machine learning consulting services

Machine learning consulting services Blockchain Development

Blockchain Development Blockchain Software Development

Blockchain Software Development Smart contract development company

Smart contract development company NFT marketplace development services

NFT marketplace development services IOS App Development

IOS App Development Android App Development

Android App Development Cross-Platform App Development

Cross-Platform App Development Augmented Reality (AR) App

Development

Augmented Reality (AR) App

Development Virtual Reality (VR) App Development

Virtual Reality (VR) App Development Web App Development

Web App Development Flutter

Flutter React

Native

React

Native Swift

(IOS)

Swift

(IOS) Kotlin (Android)

Kotlin (Android) MEAN Stack Development

MEAN Stack Development AngularJS Development

AngularJS Development MongoDB Development

MongoDB Development Nodejs Development

Nodejs Development Database development services

Database development services Ruby on Rails Development services

Ruby on Rails Development services Expressjs Development

Expressjs Development Full Stack Development

Full Stack Development Web Development Services

Web Development Services Laravel Development

Laravel Development LAMP

Development

LAMP

Development Custom PHP Development

Custom PHP Development User Experience Design Services

User Experience Design Services User Interface Design Services

User Interface Design Services Automated Testing

Automated Testing Manual

Testing

Manual

Testing About Talentelgia

About Talentelgia Our Team

Our Team Our Culture

Our Culture

Write us on:

Write us on:  Business queries:

Business queries:  HR:

HR: