Ever wondered how your phone or laptop makes banking so smooth and fast? It’s all thanks to cloud computing – the behind-the-scenes hero that ensures quick and secure banking. It’s a game changer, enabling banks to manage our money and data effortlessly. Imagine a world where keeping track of your money in the bank is as easy and safe as putting your pictures into an online photo album, with banking services that are fast and always there when you need them. This is not impossible anymore. It’s the reality unfolding before us, all because of cloud computing in the banking industry.

While numerous small businesses are skyrocketing into the cloud, banks are trailing behind. Cloud computing offers improved data management, quick service deployment, and innovative banking experiences—all while maintaining strong security and cost-efficiency. Banks have the chance to revolutionize customer service through the cloud.

Explore the transformative impact of cloud computing in banking with our latest video! Discover how “Cloud Computing in Banking” enhances data security, and customer experiences, and drives innovation within financial institutions.

Consider the profound insight of the legendary innovator, Steve Jobs:

“It’s not faith in technology. It’s faith in people.”

The banking industry is quickly moving forward, with cloud computing becoming more popular. This is shown by the strong spending of $20.9 billion by retail banks on cloud services, including things like infrastructure, platforms, and software, in 2021. The Growth is predicted, with over 22% predicted growth year-on-year until 2026. SaaS, in particular, commands the Majority of this revenue and shows no signs of relinquishing its crown.

In this blog, we explore how banks can use cloud technologies to enhance their operations, improve customer experiences, and navigate evolving financial technologies. From data to financial records, let’s uncover the transformative potential of cloud computing in banking!

The Importance of Cloud Computing in Banking

According to a report by Forrester, retail banks focusing on user experience optimization thrive three times faster than those neglecting it. In an era where consumers seek accessibility to banking services at their fingertips, avoiding cloud computing in banking and adhering to traditional models can adversely impact customer experience. Once a technological marvel, cloud computing has evolved into a one-stop solution for industries, offering advanced data storage and access services. Many companies use cloud technology to handle big amounts of data and analytics, but banks have had to switch to this technology quickly.

Moving from traditional in-house computer systems to the cloud can be hard for financial businesses. However, some, like Capital One, have fully moved to the cloud by shutting down their data centers. This shows that banks can deal with security issues and make using the cloud more common.

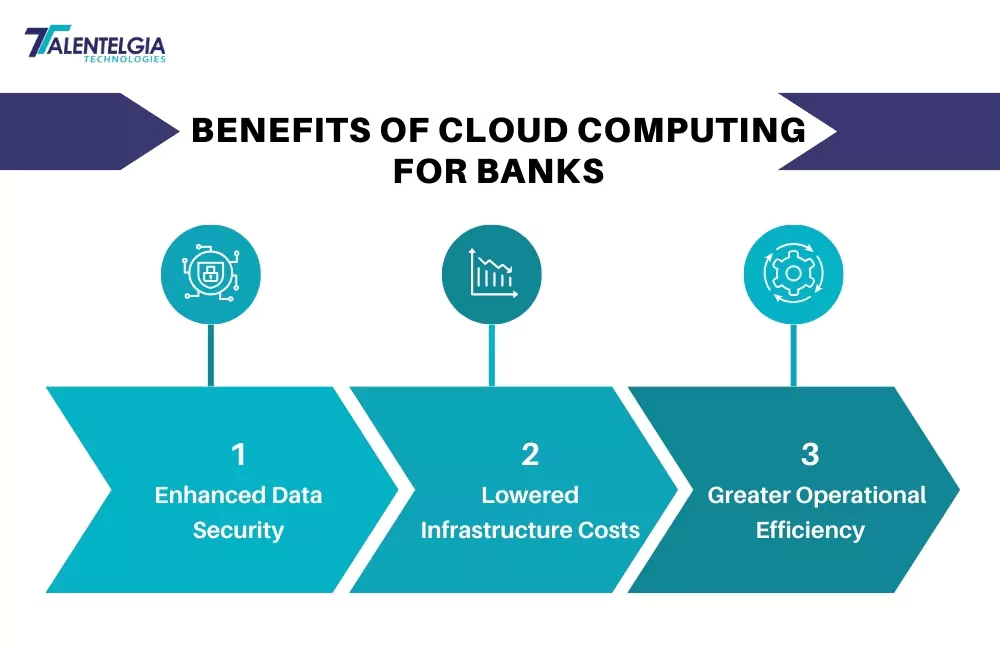

Benefits of Cloud Computing for Banks

Enhanced Data Security

Banks Adopt IT cloud infrastructure, recognizing the paramount benefits of cloud computing in securing operations. With frequent software updates, cloud computing prioritizes security. Choosing a service meeting criteria like compliance, certifications, performance, reliability, next-gen technology inclusion, migration support, and 24/7 service support is crucial.

Lowered Infrastructure Costs

While global reliance on on-premise systems remains, it poses adaptability challenges to organizational changes. AI Cloud solutions for banks make IT infrastructure changes more manageable, enabling immediate scalability. This strategic shift reduces downtime, offering a quick response to customer needs.

Greater Operational Efficiency

The cloud significantly enhances a banking institution’s efficiency. Hosting services on the cloud ensures quality control, disaster recovery, flexibility, loss prevention, and risk management. Banking portals on the cloud reduce fixed and variable expenses, guaranteeing 99% uptime.

Access to Software Applications

Cloud computing in banking leads to ERP software development and CRM development providing access to these applications, refining client relations and employee experience. Operating under the SaaS model, banks retain complete control, influencing data input and personalization scope.

Business Continuity

Cloud computing provides banking firms with an improved ability to handle faults, data protection, and disaster recovery. The technology ensures redundancy and backup at a low cost, making institutions future-proof. On-demand cloud services minimize infrastructure investment, lowering setup time and expediting product development for efficient customer response.

Green IT

Shifting banking services to the cloud reduces energy consumption and carbon footprint. This move minimizes idle time, maximizing the efficient utilization of computing power.

In recognizing the strong advantages of cloud computing for financial services, the next crucial step is selecting the best cloud services for banks.

Challenges of Cloud Adoption in Banks

Latency

The physical distance between a data center and the cloud service provider can create latency issues, impacting core banking activities like card authorization. Shifting systems from the data center to the cloud environment introduces additional latency.

Data Residency

Hosting data on the cloud raises concerns about “data ownership.” Regulatory compliances exacerbate the issue, with financial institutions encountering government-mandated limits on data storage locations.

Resilience

While cloud outages are less frequent than in traditional IT environments, they occur. Unlike traditional IT outages, the impact of cloud outages is more widespread. Banks face the potential for high-level data security breaches and unmanageable real-time downtime during such occurrences.

Risk Management Process in Cloud Banking Systems

Cloud Banking Security

Risk management plays a crucial role in ensuring the security of cloud banking systems. This process involves the identification, evaluation, implementation, and monitoring of risks to enhance the safety of users’ data and transaction details.

This risk management process is particularly essential for FinTech App Development to utilize cloud-based banking systems, guaranteeing the security and confidentiality of sensitive financial information.

Phases of the Risk Management Process

Identification of Risks

The initial step involves extensive research to identify potential risks in the cloud banking system. This includes understanding various types of risks, tools, and data stored in the cloud. After identification, the next step is calculating the impact of these risks.

Evaluation of Risk

Following risk identification is the assessment phase. This involves evaluating all potential risks and prioritizing them based on their impact on banks and customers. Risks significantly affecting the security of financial institutions and their customers take precedence.

Implementation of Risk Mitigation Measures

Prioritized risks are addressed one by one by implementing risk management techniques. While risks can’t be eradicated, they can only be minimized. Measures include setting firewalls for external threat protection, allowing only authorized personnel access to sensitive areas, encryption implementation, and having a disaster recovery plan.

These measures ensure smooth operations in a cloud-based banking system.

Monitoring and Review

The risk management process should remain adaptable. Continuous monitoring and reviews are essential for effectiveness, especially given the ever-evolving nature of technology. Adapting the risk management plan to changes in technology ensures ongoing security and operational smoothness.

Best Practices for Risk Management in Cloud Banking Systems

Strong Access Controls

Implementing robust access controls is critical for preventing unauthorized access to personal and financial information. Two-step authentication, access numbers, and codes are effective measures. Withdrawing access for terminated employees is crucial to prevent data or identity theft incidents.

Regular Security Assessments

Regular security assessments help identify and eliminate vulnerabilities in a cloud-based banking system. This involves testing technology, processes, and data for vulnerabilities. The assessment includes identifying risks, assessing each risk, prioritizing risks, and implementing mitigation strategies.

Data Encryption

Ensuring data security is pivotal, achieved through strong data encryption measures for data on the cloud. Two-step authentication should be incorporated for authorized personnel access. Firewalls are also essential to bolster network security and prevent data breaches.

Regular Software Updates and Patches

Frequent software updates and patches are vital for risk management. They allow developers to eliminate vulnerabilities, fix bugs, and enhance overall system performance. These updates align the cloud-based system with evolving technology.

Compliance with Regulatory Requirements

Financial service institutions must comply with regulatory requirements. Practices like regular security audits, real-time data sharing, and choosing reputable vendors help meet regulatory obligations. Implementing these practices eases compliance with regulatory requirements for financial service institutions.

Cloud Banking and Security – Facts and Myths

| Myths | Facts |

| Cloud is less secure than in-house infrastructure | Cloud banking invests in a robust security plan for the core business objective, creating a stronger and more secure infrastructure. |

| Cloud has access to all customer data. | Cloud computing must prioritize the security of customer data and ensure that it is not accessed or shared without permission. |

| Cloud is only suitable for applications | Cloud computing has a myriad of applications, including real-time processing, high performance, and more. |

Myth 1: Cloud applications are not secure

Reality: Cloud banking applications give importance to security. Advanced encryption measures, regular security audits, and compliance with industry standards make them secure. Banks implement robust security protocols to protect customer data and transactions.

Myth 2: Cloud applications are expensive

Reality: Cloud banking can be cost-effective. While initial setup costs may exist, the scalability of cloud applications allows banks to pay for the resources they use. This reduces infrastructure and maintenance expenses, providing a more flexible and budget-friendly solution.

Myth 3: Cloud applications are difficult to use

Reality: Cloud banking applications are designed with user-friendliness in mind. Intuitive interfaces and seamless integration make them accessible to both bank employees and customers. Training programs further simplify the adoption process.

Fact 1: Cloud applications are scalable

Cloud banking applications offer scalability to meet evolving demands. Banks can easily expand or reduce their computing resources based on requirements. This scalability enhances operational efficiency and ensures optimal resource utilization.

Fact 2: Cloud applications are innovative

Banks leverage cloud technology to introduce new services and features, enhancing the overall banking experience. Innovations such as mobile banking apps and AI-driven customer support demonstrate the adaptability and creativity of cloud applications.

Fact 3: Cloud applications are sustainable

By centralizing data storage and optimizing resource usage, cloud applications minimize energy consumption. This eco-friendly approach aligns with global efforts towards environmental responsibility.

Debunking myths and acknowledging the facts about cloud banking applications is essential. Embracing cloud technology in banking brings about improved security, cost-effectiveness, user-friendliness, scalability, innovation, and sustainability.

Real-Life Examples of Banks Benefiting from Cloud Computing

In the world of banking, some banks have benefited from cloud computing:

Capital One: Making Customers Happier

Capital One, a big bank, started using cloud services to make things better for customers and make their work smoother. The cloud helped them do things faster and more efficiently, making customers happier.

DBS Bank: Personalized Services with Data

DBS Bank, a smart bank, uses the cloud to study customer information deeply. This helped them understand what each customer likes. So, DBS Bank started offering services that are just right for each customer, making things more personal.

Ally Bank: Upgrading for Quick Changes

Ally Bank did something big by moving its main banking systems to the cloud. It wasn’t just about getting modern; it was about being flexible and able to grow quickly. With cloud technology, Ally Bank can adapt fast to changes in banking, making their work more flexible and scalable.

These stories show how using cloud computing in banking can make customers happier, offer personalized services, and make operations smoother.

Frequently Asked Questions (FAQ)

What should banks consider before moving to the cloud?

Before moving to the cloud, banks need to think about keeping things secure, following rules, protecting data privacy, making sure the cloud service is reliable, and understanding how it might affect their current systems.

What are the risks of using the cloud in banking?

Risks include problems like data leaks, not following rules, losing data, the computer systems not working sometimes, and relying on other companies for services.

What makes financial organizations successful when they use the cloud?

Successful use of the cloud involves good planning, strong security, managing risks well, clear communication, and always monitoring and making changes when needed.

Conclusion

Cloud computing is a big deal for banks, bringing changes and new ideas. With the cloud, banks can keep and organize lots of information safely, and it's flexible and can grow as needed. Important tools like online banking and customer relationship management work better because of the cloud, making them accessible from anywhere, anytime. Using the cloud in banking isn't just about technology; it helps banks change and improve. They can make more money, understand customers better, and spend less by using the cloud. The cloud breaks down barriers between different parts of a bank, making them work together better. Even though there are challenges like updating old systems and making sure data stays private, the good things about using the cloud are worth it. Banks get better security for their data, spend less on computer systems, can change and grow quickly, and use advanced tools to understand things like fraud, risk, and what their customers want. Seeing many banks already using the cloud shows that it's making a big difference in the banking world.

Healthcare App Development Services

Healthcare App Development Services

Real Estate Web Development Services

Real Estate Web Development Services

E-Commerce App Development Services

E-Commerce App Development Services E-Commerce Web Development Services

E-Commerce Web Development Services Blockchain E-commerce Development Company

Blockchain E-commerce Development Company

Fintech App Development Services

Fintech App Development Services Fintech Web Development

Fintech Web Development Blockchain Fintech Development Company

Blockchain Fintech Development Company

E-Learning App Development Services

E-Learning App Development Services

Restaurant App Development Company

Restaurant App Development Company

Mobile Game Development Company

Mobile Game Development Company

Travel App Development Company

Travel App Development Company

Automotive Web Design

Automotive Web Design

AI Traffic Management System

AI Traffic Management System

AI Inventory Management Software

AI Inventory Management Software

AI Software Development

AI Software Development  AI Development Company

AI Development Company  AI App Development Services

AI App Development Services  ChatGPT integration services

ChatGPT integration services  AI Integration Services

AI Integration Services  Generative AI Development Services

Generative AI Development Services  Natural Language Processing Company

Natural Language Processing Company Machine Learning Development

Machine Learning Development  Machine learning consulting services

Machine learning consulting services  Blockchain Development

Blockchain Development  Blockchain Software Development

Blockchain Software Development  Smart Contract Development Company

Smart Contract Development Company  NFT Marketplace Development Services

NFT Marketplace Development Services  Asset Tokenization Company

Asset Tokenization Company DeFi Wallet Development Company

DeFi Wallet Development Company Mobile App Development

Mobile App Development  IOS App Development

IOS App Development  Android App Development

Android App Development  Cross-Platform App Development

Cross-Platform App Development  Augmented Reality (AR) App Development

Augmented Reality (AR) App Development  Virtual Reality (VR) App Development

Virtual Reality (VR) App Development  Web App Development

Web App Development  SaaS App Development

SaaS App Development Flutter

Flutter  React Native

React Native  Swift (IOS)

Swift (IOS)  Kotlin (Android)

Kotlin (Android)  Mean Stack Development

Mean Stack Development  AngularJS Development

AngularJS Development  MongoDB Development

MongoDB Development  Nodejs Development

Nodejs Development  Database Development

Database Development Ruby on Rails Development

Ruby on Rails Development Expressjs Development

Expressjs Development  Full Stack Development

Full Stack Development  Web Development Services

Web Development Services  Laravel Development

Laravel Development  LAMP Development

LAMP Development  Custom PHP Development

Custom PHP Development  .Net Development

.Net Development  User Experience Design Services

User Experience Design Services  User Interface Design Services

User Interface Design Services  Automated Testing

Automated Testing  Manual Testing

Manual Testing  Digital Marketing Services

Digital Marketing Services

Ride-Sharing And Taxi Services

Ride-Sharing And Taxi Services Food Delivery Services

Food Delivery Services Grocery Delivery Services

Grocery Delivery Services Transportation And Logistics

Transportation And Logistics Car Wash App

Car Wash App Home Services App

Home Services App ERP Development Services

ERP Development Services CMS Development Services

CMS Development Services LMS Development

LMS Development CRM Development

CRM Development DevOps Development Services

DevOps Development Services AI Business Solutions

AI Business Solutions AI Cloud Solutions

AI Cloud Solutions AI Chatbot Development

AI Chatbot Development API Development

API Development Blockchain Product Development

Blockchain Product Development Cryptocurrency Wallet Development

Cryptocurrency Wallet Development About Talentelgia

About Talentelgia  Our Team

Our Team  Our Culture

Our Culture

Healthcare App Development Services

Healthcare App Development Services Real Estate Web Development Services

Real Estate Web Development Services E-Commerce App Development Services

E-Commerce App Development Services E-Commerce Web Development Services

E-Commerce Web Development Services Blockchain E-commerce

Development Company

Blockchain E-commerce

Development Company Fintech App Development Services

Fintech App Development Services Finance Web Development

Finance Web Development Blockchain Fintech

Development Company

Blockchain Fintech

Development Company E-Learning App Development Services

E-Learning App Development Services Restaurant App Development Company

Restaurant App Development Company Mobile Game Development Company

Mobile Game Development Company Travel App Development Company

Travel App Development Company Automotive Web Design

Automotive Web Design AI Traffic Management System

AI Traffic Management System AI Inventory Management Software

AI Inventory Management Software AI Software Development

AI Software Development AI Development Company

AI Development Company ChatGPT integration services

ChatGPT integration services AI Integration Services

AI Integration Services Machine Learning Development

Machine Learning Development Machine learning consulting services

Machine learning consulting services Blockchain Development

Blockchain Development Blockchain Software Development

Blockchain Software Development Smart contract development company

Smart contract development company NFT marketplace development services

NFT marketplace development services IOS App Development

IOS App Development Android App Development

Android App Development Cross-Platform App Development

Cross-Platform App Development Augmented Reality (AR) App

Development

Augmented Reality (AR) App

Development Virtual Reality (VR) App Development

Virtual Reality (VR) App Development Web App Development

Web App Development Flutter

Flutter React

Native

React

Native Swift

(IOS)

Swift

(IOS) Kotlin (Android)

Kotlin (Android) MEAN Stack Development

MEAN Stack Development AngularJS Development

AngularJS Development MongoDB Development

MongoDB Development Nodejs Development

Nodejs Development Database development services

Database development services Ruby on Rails Development services

Ruby on Rails Development services Expressjs Development

Expressjs Development Full Stack Development

Full Stack Development Web Development Services

Web Development Services Laravel Development

Laravel Development LAMP

Development

LAMP

Development Custom PHP Development

Custom PHP Development User Experience Design Services

User Experience Design Services User Interface Design Services

User Interface Design Services Automated Testing

Automated Testing Manual

Testing

Manual

Testing About Talentelgia

About Talentelgia Our Team

Our Team Our Culture

Our Culture

Write us on:

Write us on:  Business queries:

Business queries:  HR:

HR: