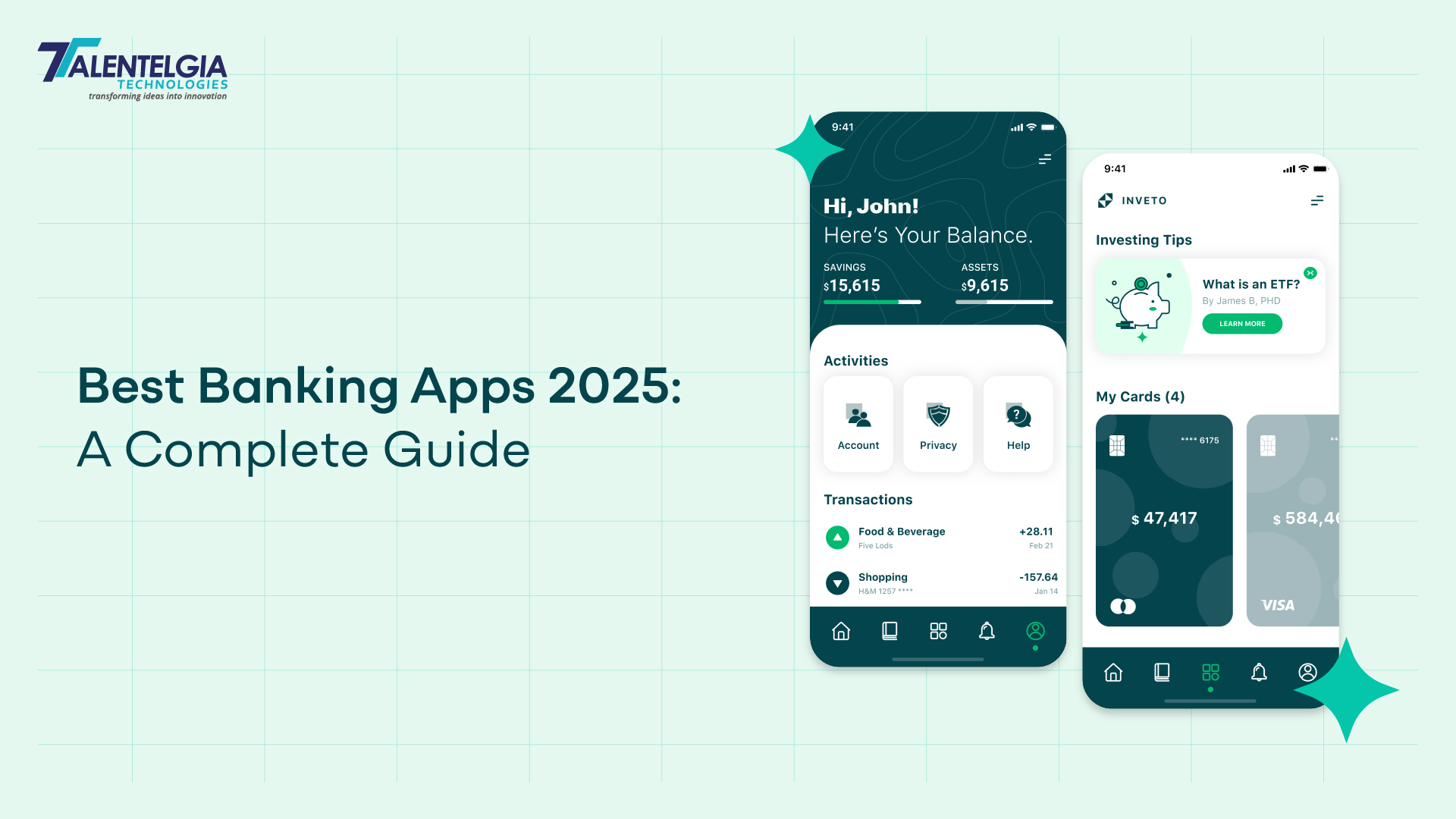

Banking apps have drastically changed the way we manage finances. They enable smooth, on-the-go handling of activities like money transfers, tracking of expenditures, and even investing. As we approach 2025, these applications are becoming advanced. This is primarily because they are adopting AI, machine learning, and blockchain technologies to increase security, speed, and convenience for users. With personalized features such as automated savings and real-time financial insights, managing your finances will be smarter and more efficient than ever before.

In this blog, we will talk about the best banking apps 2025. We’ll cover everything from everyday banking to investment management and credit score tracking. Whether you’re looking for a simple solution to manage daily transactions or an app to guide your financial growth, we have it all. Let’s dive into the future of banking!

List Of Top 10 Mobile Banking Apps for 2025

1. Wells Fargo

Wells Fargo is a leading California-based bank that has invested much in its mobile app, and thus it features on our list. The app provides a seamless banking experience and is used widely for day-to-day financial needs.

Its virtual assistant, Fargo can help monitor spending, make payments, and complete basic transactions. Users can transfer money, deposit checks, track their credit scores, and review statements all from their phones.

This app may impress well on various features, but some customers have complained that the alerts are no longer that informative. Further, sometimes it glitches, which somewhat makes it less pleasant to use. Still, Wells Fargo continues to develop new updates and has made its app a favorite for many users.

Pros

- High-rated by customers

- Convenient tracking of credit score

- Fast money transfer via Zelle

Cons

- Sometimes glitches in the app

- Alerts are not informative enough

2. Capital One

Capital One, based in Virginia, is known for its unique Capital One Cafes. It is one of the best banking apps in 2025. If you are not near capital cafes, the mobile app is a convenient way to handle daily transactions. You can deposit checks, send money with Zelle, track loans, track credit cards, and much more. CreditWise is free and also available, which includes credit score tracking and alerting you if your Social Security number has been stolen.

It also carries a widget to check the user’s accounts- like checking, saving, loans, C/D, or even credit cards-through an Apple Watch without any logging-in requirements.

Pros

- High customer ratings

- Track your credit score and identity

- View real-time credit card balances without logging in (iOS only)

Cons

- Limited customer support options

- The website provides more services than the app

3. Quontic Bank

Quontic Bank has a mobile application that is highly user-friendly, and acceptable for both Apple and Android. It has a high rating on the App Store at 4.8 and Google Play at 4.7. The bank allows customers to access their accounts, view their balances, as well as deposit checks at any time. It allows users to pay bills, track their payment history, and alert users about accounts so they can be in control of their finances.

The key feature of the app is biometric authentication, offering a second layer of security via fingerprint or facial recognition login. This way, login is quick and safe. Additionally, users can track their credit score and act if they find any discrepancies. The app is designed to make everyday banking tasks easy while providing robust features that make managing finances on the go secure and efficient.

Pros

- Bill payment and payment history tracking made simple

- Secure and fast login using fingerprint or facial recognition

Cons

- Limited investment account features

- Some users report occasional app lag or delays in processing transactions

Also Read: Fintech Mobile App Features

3. American Express

American Express is most famous for credit cards but offers bank accounts and loans. This makes it one of the best banking apps in 2025. The Amex app lets its users manage all their accounts in one place. It includes Amex Offers, which is a rewards program with discounts and perks such as cashback.

Customer service is available 24/7 via live chat within the app, but there is no virtual assistant. You can send money via PayPal or Venmo, but Zelle is not supported. Customers rate the app highly, but some report glitches and delays on Android devices according to our research.

Pros

- Manage multiple accounts in one app.

- Access discounts and statement credits through Amex Offers.

Cons:

- No virtual assistant.

- Zelle is not supported for money transfers.

Varo Bank

Varo Bank’s mobile app has all the smooth banking features. You can easily check your balances, send peer-to-peer payments, and see your credit score.

The app also sends you real-time transaction alerts to keep you updated. To get customer support, you can connect via live chat.

You can use the app for budgeting, setting savings goals, and making quick payments. It is available on both the App Store and Google Play and has high user ratings.

Varo offers a clean and user-friendly interface to all your accounts, making easy access both easy and enhanced with financial insights and instant transfers.

Pros

- Real-time transaction alerts keep you informed.

- Easy access to account features, including live chat support.

Cons

- Limited in-person banking options.

- Some users report occasional app glitches.

First Foundation Bank

First Foundation Bank’s mobile app ensures easy management of accounts, where customers can quickly sync the accounts and transfer money from one account to another. Seamlessly, you can deposit checks, track any transaction, and manage spending with real-time alerts.

One of the standout features is the FinSights tool, which provides personalized insights into your financial habits. It helps customers understand spending patterns and gives a clear view of financial health with the unique FinStrong score. This app also supports Zelle for fast, secure peer-to-peer payments.

First Foundation Bank’s app is one of the contenders for the best banking app 2025, given its comprehensive set of features and focus on personalized financial insights.

Pros

- Quickly sync accounts and transfer funds.

- Personalized financial insights using the FinSights tool.

Cons

- There are fewer mobile features than in bigger banks.

- Not supportive of the advanced investment tools.

SoFi

The SoFi mobile app provides the tools to maintain and manage finances. It provides features like tracking the balances and keeping track of saving goals. Other functionalities include savings vaults organization of cash, the option to deposit checks, and opt-in to round-ups.

The priority of SoFi is security, which is furthered through the inclusion of two-factor authentication, in-app card locking, and 24/7 account monitoring to ensure data protection. In addition, an easy-to-navigate app provides users with access to the management of finances on the go, thus guaranteeing a smooth experience for everyone.

Pros

- Tracks balance easily and sets up savings goals.

- It comes with powerful security options such as two-factor authentication and in-app card locking

Cons

- The Android version has a lower rating than the iOS

- Investment options are less than other banking apps.

Discover

Discover is one of the leading online banking firms providing their clients with several options including credit cards, checking, and savings accounts. On-the-go accessibility, transferring of funds, and deposits by checks can all be facilitated with the Discover mobile application; it freezes any debit or credit cards lost or stolen; reminders regarding when to pay the payment become accessible as well.

The app offers ATM location search, free FICO score access, and bill payments. Although Discover is a robust app, it lacks a virtual assistant and doesn’t offer the advanced budgeting tools that are present in some of its competitor apps.

Pros

- Free access to your FICO score.

- Access to your early deposit for faster funds availability.

Cons

- You may not view older transactions easily.

- Does not have a virtual assistant for customer support.

PNC Bank

PNC Bank headquartered in Pittsburgh, has a robust mobile app for account management, transferring money, and depositing checks. The app supports multiple account types, including credit card and bank accounts. Users can also access additional features such as Paze, which adds security to online shopping by replacing card numbers.

Express Funds by PNC allows for faster access to deposited checks, though for a fee. Users who do not have a PNC credit card will not be able to check their credit score in the app easily. Overall, while robust, some features are limited depending on the account type.

Pros

- Manage multiple types of accounts with ease.

- Increased security when shopping online through Paze.

Cons

- No virtual assistant to assist with questions.

- Can’t check your credit score without having a PNC credit card.

Chase

Chase, New York-based, operates more than 4,700 locations throughout the country. You can manage several accounts using the Chase mobile app, including credit cards and investments. You can use Zelle to transfer money, deposit checks, and schedule automatic transfers. It also provides you with Chase Offers, offering discounts from leading retailers and restaurants.

The app features a digital assistant to help check balances, pay bills, and get routing numbers. However, customer support is only available through an internet browser, not directly within the app. The app’s extensive features may overwhelm users, making navigation challenging for basic transactions.

Chase continues to be the great competitor for the best banking app 2025, especially for users looking for a variety of services and features in one place.

Pros

- Manage multiple account types in one place.

- Access Chase Offers discounts from retailers and restaurants.

Cons

- Limited customer service options.

- Navigation can be difficult for new users.

Conclusion

The best banking apps 2025 boast high features, enhancement in security aspects, and even a user-friendly interface to fulfill growing demands by very tech-savvy consumers. Whether managing day-to-day transactions, observing credit scores, or looking for very advanced investment management tools, there is everything present in these applications. From Wells Fargo's virtual assistant to Chase's wide array of offerings and security measures, such as two-factor authentication with SoFi, these platforms make managing your finances easier, more secure, and more convenient than ever. Still, some apps have limitations in customer support, navigation, or access to advanced features, which may be a consideration when choosing the best option for your banking needs. Therefore, the best banking app for you would depend on your unique set of financial goals, preferences, and services you may need.

Healthcare App Development Services

Healthcare App Development Services

Real Estate Web Development Services

Real Estate Web Development Services

E-Commerce App Development Services

E-Commerce App Development Services E-Commerce Web Development Services

E-Commerce Web Development Services Blockchain E-commerce Development Company

Blockchain E-commerce Development Company

Fintech App Development Services

Fintech App Development Services Fintech Web Development

Fintech Web Development Blockchain Fintech Development Company

Blockchain Fintech Development Company

E-Learning App Development Services

E-Learning App Development Services

Restaurant App Development Company

Restaurant App Development Company

Mobile Game Development Company

Mobile Game Development Company

Travel App Development Company

Travel App Development Company

Automotive Web Design

Automotive Web Design

AI Traffic Management System

AI Traffic Management System

AI Inventory Management Software

AI Inventory Management Software

AI Software Development

AI Software Development  AI Development Company

AI Development Company  AI App Development Services

AI App Development Services  ChatGPT integration services

ChatGPT integration services  AI Integration Services

AI Integration Services  Generative AI Development Services

Generative AI Development Services  Natural Language Processing Company

Natural Language Processing Company Machine Learning Development

Machine Learning Development  Machine learning consulting services

Machine learning consulting services  Blockchain Development

Blockchain Development  Blockchain Software Development

Blockchain Software Development  Smart Contract Development Company

Smart Contract Development Company  NFT Marketplace Development Services

NFT Marketplace Development Services  Asset Tokenization Company

Asset Tokenization Company DeFi Wallet Development Company

DeFi Wallet Development Company Mobile App Development

Mobile App Development  IOS App Development

IOS App Development  Android App Development

Android App Development  Cross-Platform App Development

Cross-Platform App Development  Augmented Reality (AR) App Development

Augmented Reality (AR) App Development  Virtual Reality (VR) App Development

Virtual Reality (VR) App Development  Web App Development

Web App Development  SaaS App Development

SaaS App Development Flutter

Flutter  React Native

React Native  Swift (IOS)

Swift (IOS)  Kotlin (Android)

Kotlin (Android)  Mean Stack Development

Mean Stack Development  AngularJS Development

AngularJS Development  MongoDB Development

MongoDB Development  Nodejs Development

Nodejs Development  Database Development

Database Development Ruby on Rails Development

Ruby on Rails Development Expressjs Development

Expressjs Development  Full Stack Development

Full Stack Development  Web Development Services

Web Development Services  Laravel Development

Laravel Development  LAMP Development

LAMP Development  Custom PHP Development

Custom PHP Development  .Net Development

.Net Development  User Experience Design Services

User Experience Design Services  User Interface Design Services

User Interface Design Services  Automated Testing

Automated Testing  Manual Testing

Manual Testing  Digital Marketing Services

Digital Marketing Services

Ride-Sharing And Taxi Services

Ride-Sharing And Taxi Services Food Delivery Services

Food Delivery Services Grocery Delivery Services

Grocery Delivery Services Transportation And Logistics

Transportation And Logistics Car Wash App

Car Wash App Home Services App

Home Services App ERP Development Services

ERP Development Services CMS Development Services

CMS Development Services LMS Development

LMS Development CRM Development

CRM Development DevOps Development Services

DevOps Development Services AI Business Solutions

AI Business Solutions AI Cloud Solutions

AI Cloud Solutions AI Chatbot Development

AI Chatbot Development API Development

API Development Blockchain Product Development

Blockchain Product Development Cryptocurrency Wallet Development

Cryptocurrency Wallet Development About Talentelgia

About Talentelgia  Our Team

Our Team  Our Culture

Our Culture

Healthcare App Development Services

Healthcare App Development Services Real Estate Web Development Services

Real Estate Web Development Services E-Commerce App Development Services

E-Commerce App Development Services E-Commerce Web Development Services

E-Commerce Web Development Services Blockchain E-commerce

Development Company

Blockchain E-commerce

Development Company Fintech App Development Services

Fintech App Development Services Finance Web Development

Finance Web Development Blockchain Fintech

Development Company

Blockchain Fintech

Development Company E-Learning App Development Services

E-Learning App Development Services Restaurant App Development Company

Restaurant App Development Company Mobile Game Development Company

Mobile Game Development Company Travel App Development Company

Travel App Development Company Automotive Web Design

Automotive Web Design AI Traffic Management System

AI Traffic Management System AI Inventory Management Software

AI Inventory Management Software AI Software Development

AI Software Development AI Development Company

AI Development Company ChatGPT integration services

ChatGPT integration services AI Integration Services

AI Integration Services Machine Learning Development

Machine Learning Development Machine learning consulting services

Machine learning consulting services Blockchain Development

Blockchain Development Blockchain Software Development

Blockchain Software Development Smart contract development company

Smart contract development company NFT marketplace development services

NFT marketplace development services IOS App Development

IOS App Development Android App Development

Android App Development Cross-Platform App Development

Cross-Platform App Development Augmented Reality (AR) App

Development

Augmented Reality (AR) App

Development Virtual Reality (VR) App Development

Virtual Reality (VR) App Development Web App Development

Web App Development Flutter

Flutter React

Native

React

Native Swift

(IOS)

Swift

(IOS) Kotlin (Android)

Kotlin (Android) MEAN Stack Development

MEAN Stack Development AngularJS Development

AngularJS Development MongoDB Development

MongoDB Development Nodejs Development

Nodejs Development Database development services

Database development services Ruby on Rails Development services

Ruby on Rails Development services Expressjs Development

Expressjs Development Full Stack Development

Full Stack Development Web Development Services

Web Development Services Laravel Development

Laravel Development LAMP

Development

LAMP

Development Custom PHP Development

Custom PHP Development User Experience Design Services

User Experience Design Services User Interface Design Services

User Interface Design Services Automated Testing

Automated Testing Manual

Testing

Manual

Testing About Talentelgia

About Talentelgia Our Team

Our Team Our Culture

Our Culture

Write us on:

Write us on:  Business queries:

Business queries:  HR:

HR: